Weakness in the price of oil is likely to lead to a buying opportunity as its period of seasonal strength begins in the days ahead.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

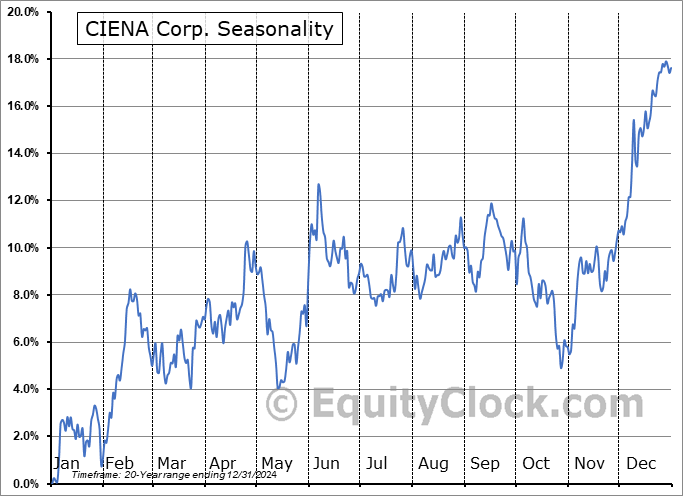

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks continue to show the kind of pull/digestion that is normal through the first half of December as investor take advantage of tax loss selling and execute end-of-year trades. The S&P 500 Index closed down by just less than four-tenths of one percent, continuing to show hesitation just below the July high and resistance around 4600. After days of hinting of an imminent bearish crossover of MACD, the momentum indicator confirmed the sell signal on Wednesday, joining similar sell signals with respect to Stochastics and RSI that have been triggered in recent days. While this negative near-term revelation is likely to lead to the continuation of the weakness through the middle of the month, these momentum indicators are still showing characteristics of a bullish intermediate-term trend above their middle lines. Support below the market remains plentiful with the most likely target attributed to the traditional tax loss selling period as being the mid-November upside open gap around 4450. Seasonal weakness through the first half of December tends to provide the ideal setup for strength during the notorious Santa Claus rally timeframe in the back half of the month.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite