Credit conditions and market liquidity that are the best in 20 months working to support stocks through this seasonally strong time of year.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

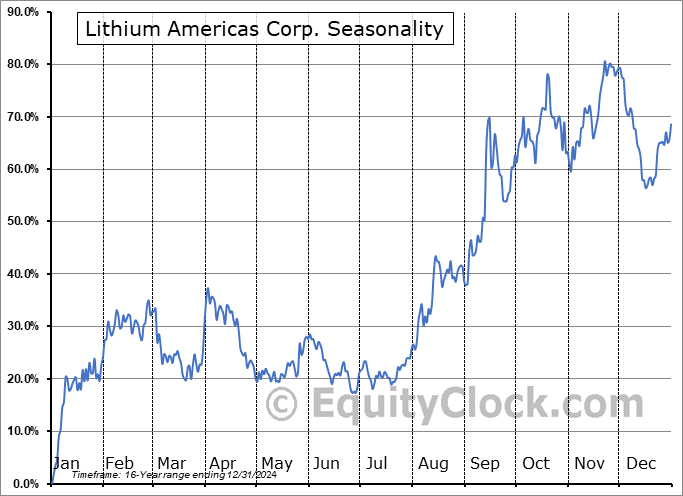

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks continued their relentless push higher on Tuesday as portfolio managers chase performance into year end. The S&P 500 Index added nearly six-tenths of one percent, feeling the pull from previous resistance at the all-time high that was charted nearly two years ago at 4800. The benchmark continues to become increasingly overbought with the Relative Strength Index (RSI) now above 82. This is the highest level that this momentum indicator has shown since September of 2020, just prior to a quick 10% correction that played out over a three-week period that followed. There remains a near-term risk of a quick gut-check as buying demand becomes exhausted, but with seasonal tendencies for the market remaining positive into the start of the new year, the likely timeframe to realize this digestion is following the first week of January. The intermediate-term trend of the market, which is the priority in our seasonal process, remains well supported and we are still far away from seeing a topping pattern of significance that would warrant a negative view from a technical perspective. Horizontal resistance at 4800 will be highly scrutinized as it is the last point of reference from a technical perspective until the benchmark gets into clear air in record high territory. Moving averages are all sloped higher with the shorter of the averages hovering above the longer ones, characteristic of a bullish trend.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite