The percentage rise in Continued Jobless Claims last year was the highest on record for a period not defined as a recession.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks closed rather flat on Thursday following the release of a hotter than expected read of inflation for the month of December. The S&P 500 Index closed down by just less than a tenth of one percent, continuing to hold between significant horizontal resistance at 4800 and short-term support at the rising 20-day moving average at 4744. Major moving averages continue to fan out and momentum indicators are holding above their middle lines, both characteristics of a bullish trend. Investors are seemingly just waiting for a bullish catalyst to fuel a breakout above the 4800 hurdle that has capped the benchmark for the past two years; without one, this muddling below the all-time peak could persist.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

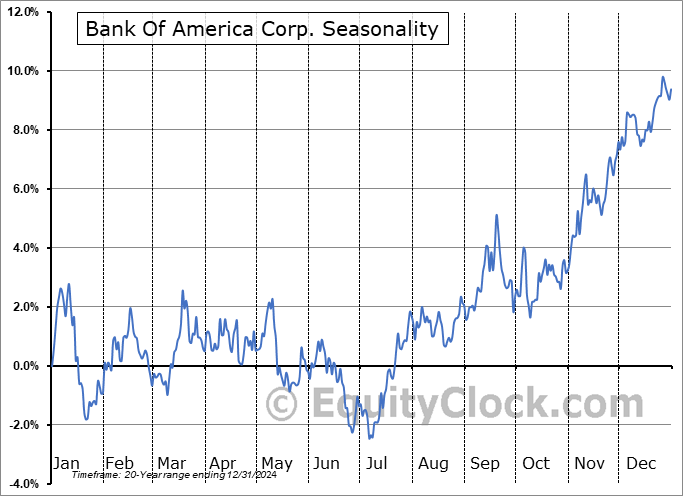

S&P 500 Index

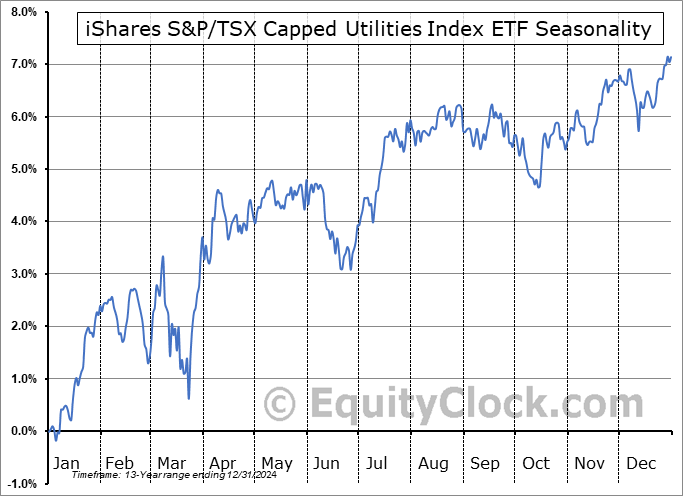

TSE Composite