Equity market performance in the month of February is typically nothing notable with the S&P 500 Index averaging a loss of 0.1%, based on data from the past two decades.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks dropped on Wednesday as investors sold off big-tech stocks following earnings and reacted to statements from Fed Chair Jerome Powell, who poured cold water on the prospect of seeing a rate cut as early as March. The S&P 500 Index ended down by 1.61%, realizing the worst single session decline since September amidst the third quarter pullback. The loss on the day certainly imposes a threatening look to the short-term trend, something that was at risk anyways given how overbought the market had become, but there is certainly no damage being inflicted on the intermediate-term path, yet. The benchmark remains above previous resistance at 4800 that capped upside momentum for the past couple of years and major moving averages remain firmly below present levels. While the Relative Strength Index (RSI) has pulled back out of overbought territory, characteristics of a bullish trend remain with both MACD and RSI above their middle lines. What does raise a point of concern pertaining to the intermediate-term path is the possible lower-high of both RSI and MACD below their December highs, threatening to reveal a divergence versus price. If confirmed, this would be indicative of waning upside momentum, a potential precursor to a more substantial pullback ahead. December’s RSI and MACD readings set a high bar, therefore it seemed likely that the benchmark would not be able to overcome that previous threshold. The last negative momentum divergence that was observed with respect to these indicators was recorded in July, ahead of the correction that played out in stocks through the remainder of the third quarter. The difference between now and then is that back in July investor sentiment was overly bullish and highlighted complacency, while current sentiment readings are pointing to a more neutral bias. This is not the setup, yet, to be bearish of stocks over a sustained timeframe, although we could be setting up for such a shift of trend ahead.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

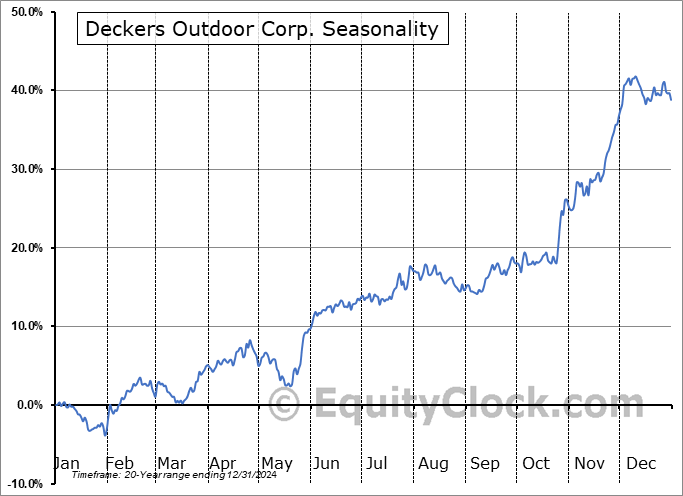

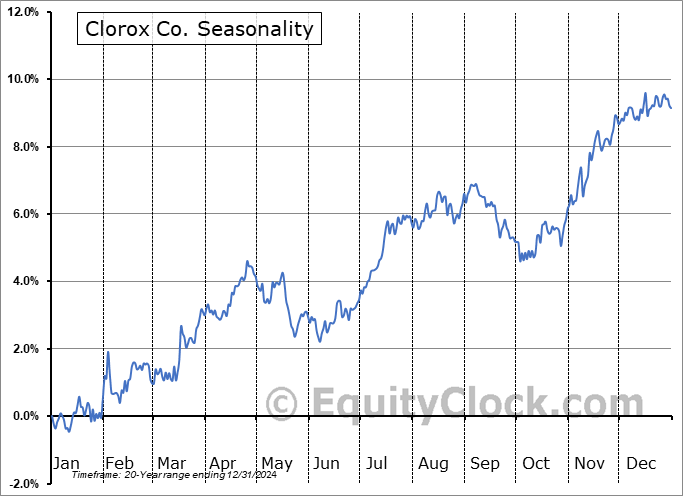

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite