The market is stealthily pricing in the uptick of inflationary pressures, emphasizing the importance of tailoring portfolios to areas of the market that continue to have pricing power.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks closed little changed on Wednesday as investors awaited earnings from NVIDIA after the closing bell. The S&P 500 Index ended the day with a gain of just over one-tenth of one percent, managing to climb out of negative territory that was seen through much of the session. Once again, short-term support at the rising 20-day moving average (4955) was tested, enticing buyers to step in order to bet on the positive intermediate-term trend that is ongoing. Near-term, conditions remain dicey as the market progresses further into this period of seasonal weakness that dominates that back half of February. Momentum indicators (MACD and RSI) continue to show negative divergences versus price, an indication of upside exhaustion. Levels down to 4600 on the large-cap benchmark are fair game, accounting for a normal and healthy correction of the recent market strength, a retracement that, if realized, would provide the ideal setup for the strength that is normal through March and April.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

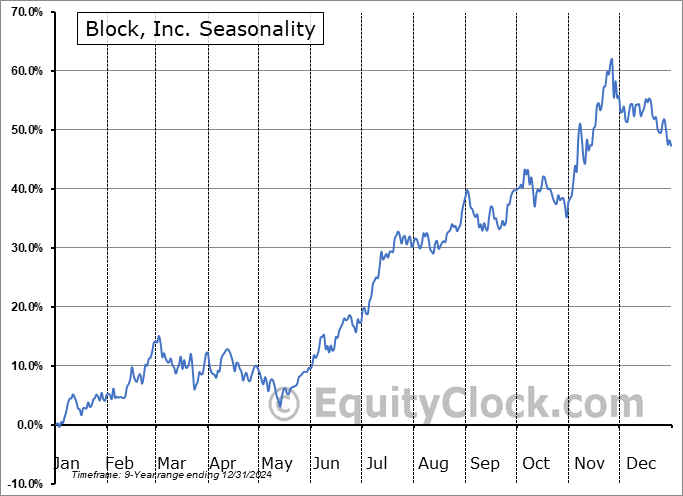

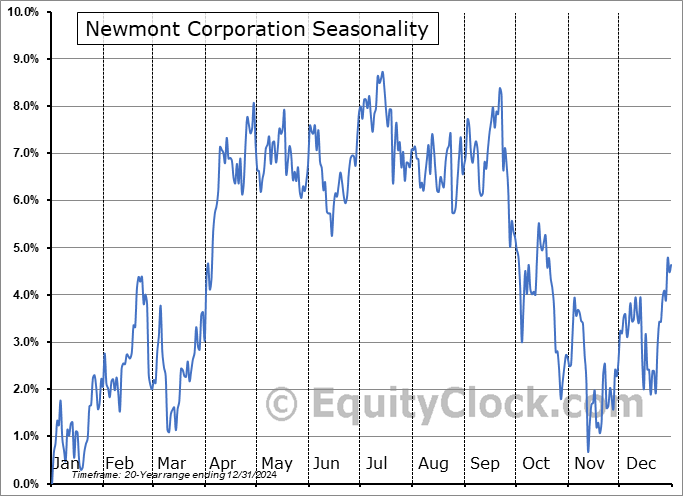

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite