Money managers continue to hold a near-record short allocation in treasury bond futures, providing a powder keg to prices that could be ready to explode.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks dropped on Tuesday as profit-taking in the technology sector placed broader benchmarks on a bit of a shaky footing as we progress towards the end of the first quarter. The S&P 500 Index closed down by 1.02%, reaching back towards short-term support at the rising 20-day moving average (5038). The variable hurdle aligns with the upper limit of the upside open gap that was charted following the NVIDIA surge between 4983 and 5038, a span that is likely to garner reaction in the short-term, should this selloff continue into the days ahead. As we have been emphasizing for weeks, momentum indicators continue to negatively diverge from price, indicative of waning buying demand, typically a precursor to a short-term pullback. While near-term digestion should be expected, there is little risk to the rising intermediate-term path of the benchmark stemming from the October of 2022 low, particularly with the positivity that is normal of the equity market through the tail-end to the best six months of the year performance that peaks in May. Selling upside calls on long allocations remains the most effective strategy under this backdrop where there are near-term downside risks to prices as the technology sector corrects some of the imbalances that had been built up in the past few months; our core equity allocation in the Super Simple Seasonal Portfolio is one such way to execute this approach. The near-term digestive/rebalance phase where selling upside calls on portfolio positions is appropriate is expected to persist through the month of March.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

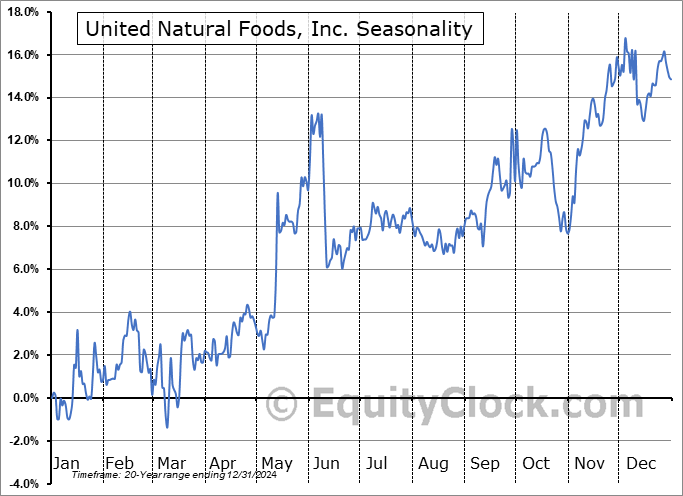

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite