Economic indicators that were expressing weakness last year are highlighting strength early into 2024, a result that portends to rotation to some of the areas of the equity market that have lagged.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks slipped slightly on Friday as traders took a breather following another week of strength. The S&p 500 Index closed down by just over a tenth of one percent, remaining within arm’s reach of the all-time highs charted in recent days. Short-term support remains well defined at the 20-day moving average (5140), keeping the grind higher in prices that has been observed this year on a positive slope heading into the strength that is normal for the month of April. Negative divergences with respect to MACD and RSI are not going away, highlighting the waning interest of portfolio managers to buy at these market heights, but this has yet to turn off the flow of funds into stocks. The rise in prices has remained orderly and has yet to provide indications of excess, despite the seemingly overvalued state of price-earnings multiples. Sentiment will be an important guide for seasonal investors as we transition into the spring and head towards the off-season for stocks that normally starts in May; further strength, as per seasonal norms, through the month ahead resulting in indications of complacency could be the cue to ratchet back risk exposure given the vulnerability that would imposed to the rising trajectory. With many still skeptical of the sustainability of the market strength, the chase for performance and the grind higher in prices can be expected to continue.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Sectors and Industries entering their period of seasonal strength:

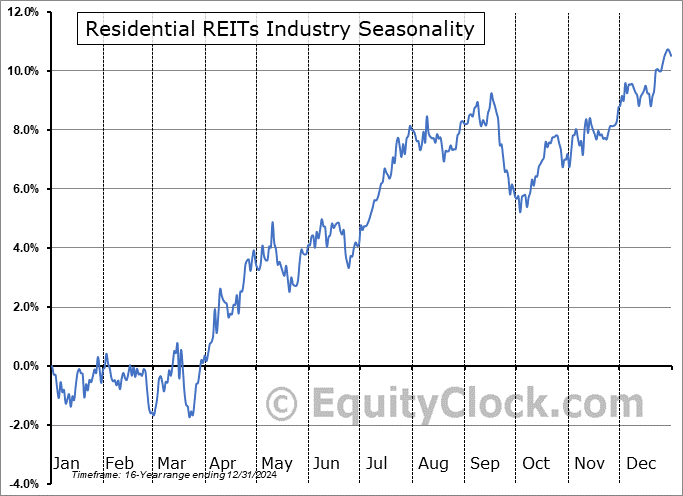

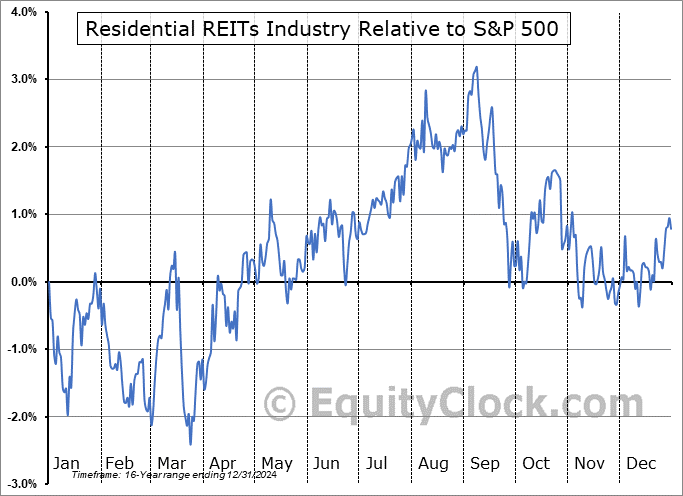

Analysis of the Residential REITs Industry seasonal charts above shows that a Buy Date of March 24 and a Sell Date of June 17 has resulted in a geometric average return of 2.95% above the benchmark rate of the S&P 500 Total Return Index over the past 15 years. This seasonal timeframe has shown positive results compared to the benchmark in 12 of those periods. This is a very good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 15 years by an average of 7.27% per year.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite