May tends to be a lack-lustre month, performance-wise, for stocks with the S&P 500 Index averaging a gain of a mere 0.2% over the past two decades.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks closed firmly lower in the final session of April as renewed inflation concerns drove up the cost of borrowing and fuelled a selloff in the equity market. The S&P 500 Index closed down by 1.57%, turning lower from the confluence of resistance at the 20 and 50-day moving averages around 5120. Support continues to underpin the market at the 100-day moving average (4970), but Tuesday’s session provides the first significant clue that the benchmark may no longer be on a path where levels of support outweigh levels of resistance. The adoption of a short to intermediate-term declining trend is the risk and the rollover of the Relative Strength Index (RSI) below its middle line starts the process of adopting characteristics of a bearish path. It is always difficult to use the final session of the month as indication of the overall trend ahead given the tendency of portfolio manages to window dress/right size allocations, but the progression of the bounce from last week’s low at the 100-day moving average is certainly enough to elevate concerns that the pullback in stocks has further room to run on the downside. Intermediate-term risks are down to the breakout range between 4600 and 4800, a target that was not expected to be achieved until further into the off-season for stocks that starts next week, but Tuesday’s prices action suggest that we need to be cognizant of this downside potential now. Traditionally, the first few days of May are positive for stocks, but with headlines risks remaining high, it would be foolish to hook our wagon to normal patterns while headwinds against stocks are growing. Through the next six months, a more conservative stance to portfolio positioning has been appropriate and the market is providing some strong indications that this may be a prudent strategy this year.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

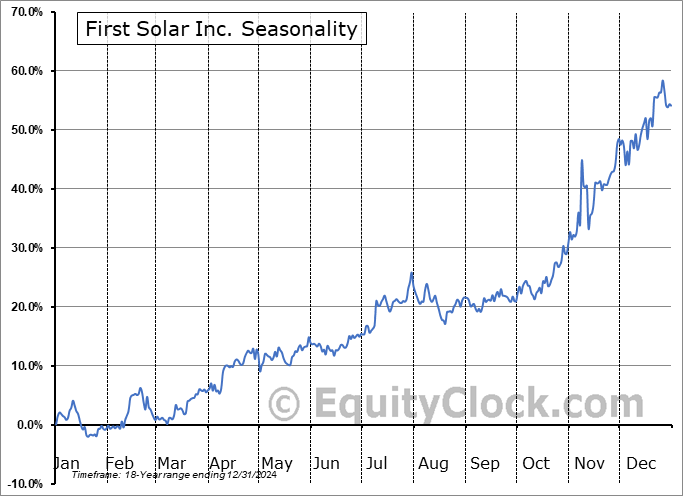

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite