An outside reversal candlestick on major equity benchmarks is threatening to produce a significant topping pattern.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

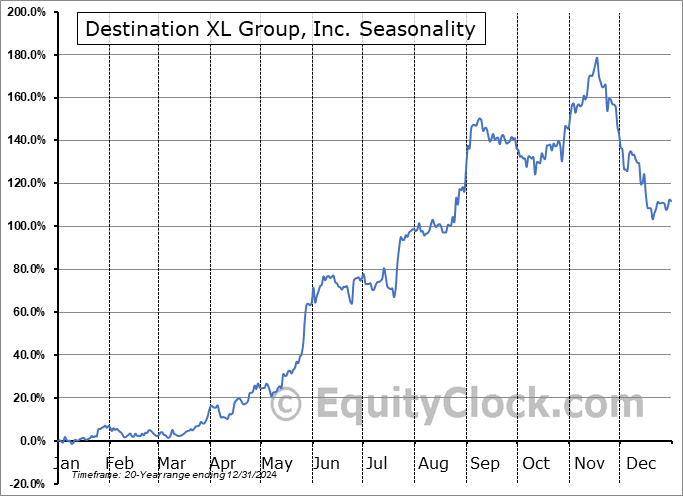

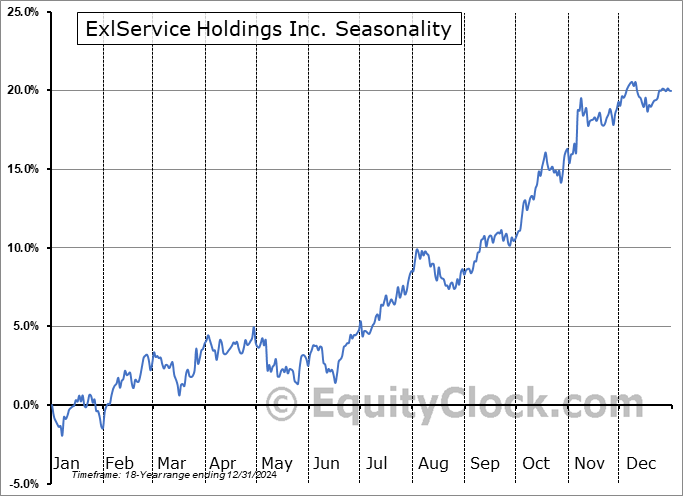

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks closed broadly lower on Thursday as a slight uptick in interest rates and the desire of traders to hold a neutral allocation to risk ahead of the long weekend had market participants hitting the sell button. The S&P 500 Index closed down by around three-quarters of one percent, charting an outside reversal candlestick on the day. The bearish setup is derived by an open above the prior session’s high followed by a close below the prior session’s low, effectively encompassing the previous day’s range. This is a mark of upside exhaustion and the fact that it is occurring just slightly above the previous peak in the market charted in March raises the risk of a significant intermediate-term topping pattern developing. Thursday’s move resolves a short-term consolidation span that developed in recent days between 5285 and 5325, projecting downside risks of the same magnitude of the prevailing range, or to 5245. Momentum indicators on the daily chart continue to roll over below their previous peaks, showing yet another divergence versus price that once again emphasizes waning buying demand and the lack of interest in committing new funds around these market peaks. MACD is threatening to reveal another sell signal in the days ahead should it cross back below its signal line. The price action that is playing out could easily deny the recent breakout move in this and other benchmarks (eg. Dow Jones Industrial Average, Small Caps, Mid-Caps), enticing traders to step back while upside momentum struggles. While seasonal tendencies typically support stocks around the Memorial Day holiday, this positivity may have been exhausted earlier in the month, providing the setup to see an earlier than normal start to the span of weakness that weighs on equity benchmarks through the month of June. The summer rally period for stocks is around a month away (around the end of June), leaving this timeframe in the interim where a sideways to lower drift is certainly reasonable, perhaps allowing for more favourable levels to buy stocks for the period of seasonal strength in a few weeks from now. Thursday’s price action and the risk aversion that has developed in recent days/weeks is providing compelling evidence that the market bulls are tired.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite