The divergence of the price of oil compared to the average trend of strength over the past couple of months highlighting the market’s skepticism pertaining to the demand profile of the commodity (and the strength of the economy) moving forward.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

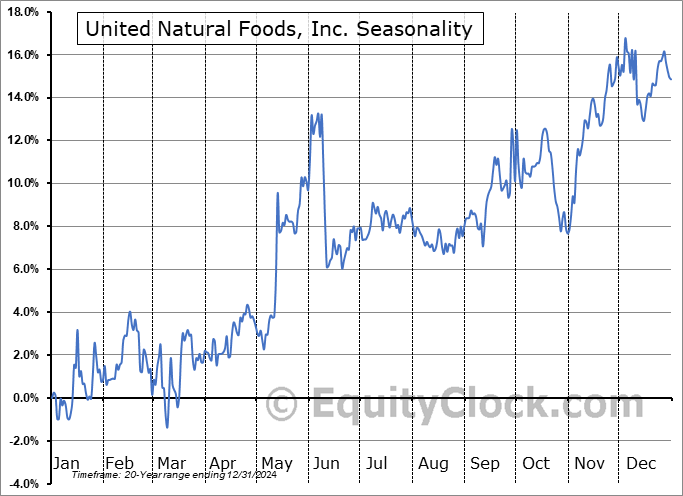

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks closed mixed on Tuesday as risk aversion in the market continues to grip trading activity. The S&P 500 Index closed with a gain of just over a tenth of one percent, making incremental upside progress above support at 20 and 50-day moving averages. The 100-day moving average continues to underline the positive intermediate-term trend, but topping patterns on the charts of core-cyclical segments of the market and evidence of waning buying demand around these record heights threatens a violation of the significant level below as the off-season for stocks progresses. Negative momentum divergences on the chart have failed to confirm the higher levels above the March peak and a double-top setup is the risk, a pattern that would forecast a test of the rising 200-day moving average at 4782. The equity market had an excellent “on-season” between October and May and now is the time to pay the piper as economic momentum cools and as traders shy away from risk. Seasonally, the middle of June tends to encompass one of the weakest periods of the year for stocks (see out monthly outlook), providing little reason to be aggressive in the equity market until closer to the end of the month.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite