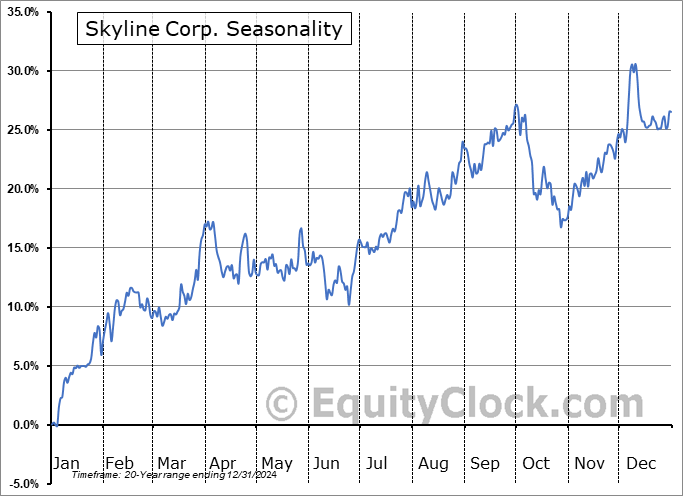

Setting up for the summer rally, followed by the period of volatility for stocks, spanning the third quarter.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks closed mixed on Monday as technology continues to mean revert ahead of the end of the quarter. The S&P 500 Index closed with a loss of three-tenths of one percent, making incremental moves to peel back on the strength that has been achieved just in the month of June. The benchmark has done an effective job of mitigating the weakness that is normal at this time of year when portfolio managers re-balance away from their winners and towards their losers in order to bring allocations back inline with investment policy guidelines. Overbought conditions are starting to alleviate with the Relative Strength Index (RSI) slipping back below 70. While the market has not delivered the magnitude of declines that would traditionally be expected of this mean-reversion timeframe, it is doing exactly what is normal at this time of year by relaxing any stretched conditions before the summer rally period takes hold through the last couple of sessions of June. Stops to the summer rally trade can continue to be pegged at the rising 50-day moving average, presently hovering around 5237. Should seasonal norms hold true, a couple more sessions of this mean-reversion/portfolio rebalance period before the summer rally timeframe gets underway, a positive mid-year influence that tends to lift a wide array of stocks through the first three weeks of July.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite