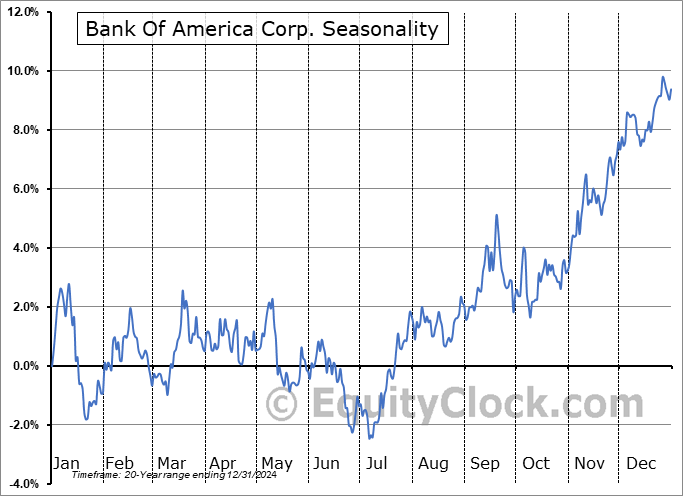

A major downturn in the equity market is unlikely so long as the banks remain supported.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks clawed their way higher on Monday as the summer rally buoyancy that lifts stocks to start the third quarter remains alive and well. The S&P 500 Index closed with a gain of just less than three-tenths of one percent, achieving another fresh intraday record high as the rotation into many of this year’s laggards attempts to take hold. Support at the 20-day moving average (5518) continues to underpin this short-term move higher as the benchmark wades through an overbought state, according to the Relative Strength Index (RSI). Major moving averages continue to fan out positively, portraying everything that is desired to hold a bullish bias of stocks, particularly at this seasonally strong time of the year. The period of average volatility follows this strong mid-year period for stocks, therefore planning out stops on current holdings may be prudent to assure that risk mitigation efforts through August, September, and October are deployed effectively while looking for the opportunity to overweight bond market allocations.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

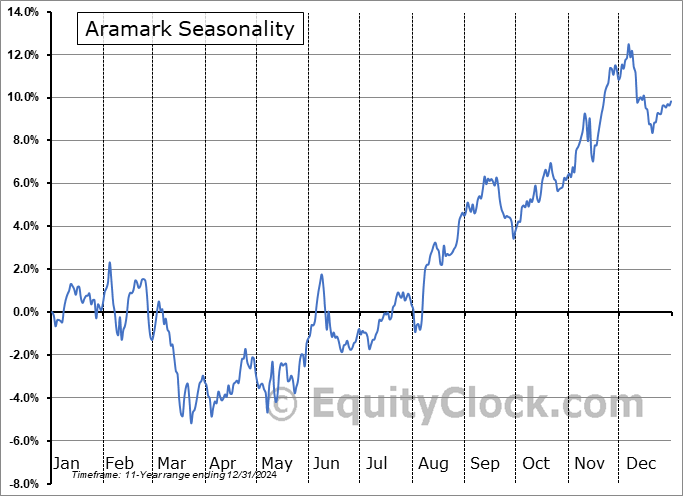

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite