Dow Theory is failing to confirm the new highs and bullish trend in many of the broad market benchmarks given the capped performance of transportation stocks from the past few years.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks closed little changed to end the week as market held onto the strength attributed to the Fed’s unexpected move to cut rates by an outsized 50 basis points on Wednesday. The S&P 500 Index shed a mere two-tenths of one percent, remaining above horizontal resistance that was broken on Thursday at 5650. Support remains well defined at the 100-day moving average (5434). The technicals suggest the continuation of the near-term direction of travel, which is higher, despite being within this weak time of year for equity market performance at the end of the second quarter. Seasonality has us locked into this cautious view of stocks through the remaining days of September, but the strength that the market has been revealing certainly diminishes the threat of an intermediate-term topping pattern that was apparent previous.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Sectors and Industries entering their period of seasonal strength:

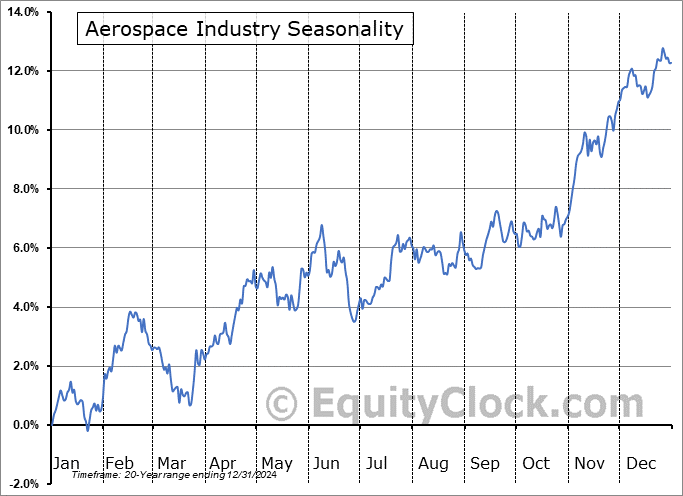

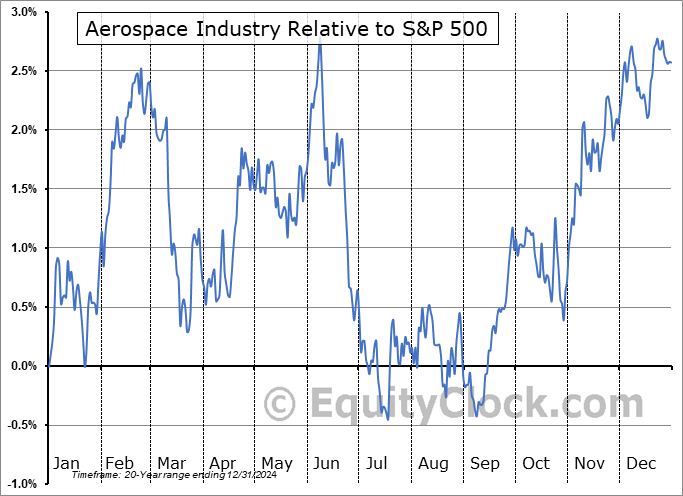

Analysis of the Aerospace Industry seasonal charts above shows that a Buy Date of September 23 and a Sell Date of February 14 has resulted in a geometric average return of 3.75% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 18 of those periods. This is an excellent rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 3.18% per year.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite