Interest rate sensitive segments have pulled back and are now showing positive reaction to levels of rising trendline support.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

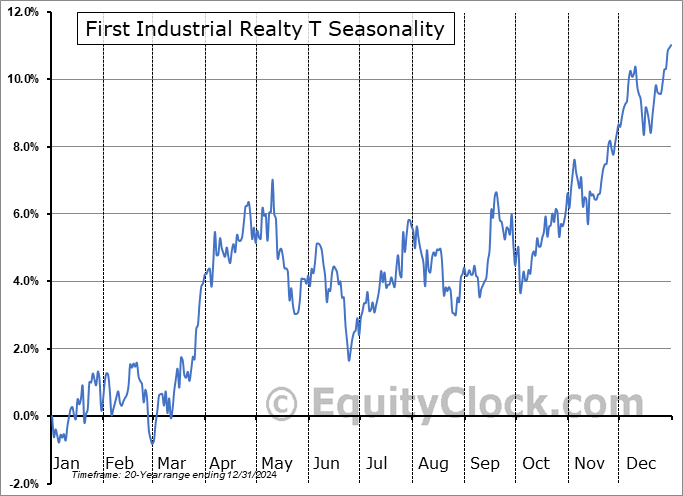

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks slipped on Tuesday amidst a wobble that surrounded the reaction to earnings season, which continues to become busier by the day. The S&P 500 Index closed down by around three-quarters of one percent, erasing the gain that was achieved in the slower Columbus Day holiday session on Monday. Support continues to be pinned at previous resistance of 5669, along with the 20-day moving average that is hovering around 5741. Despite evidence of waning upside momentum within this tail-end to the period of seasonal volatility for stocks, this market is showing greater evidence of support than resistance, a characteristic of a bullish trend. We continue to like the groups that are on our list of Accumulate candidates, but there are certainly segments of the market to Avoid. The ability of the market, as a whole, to overcome the period of seasonal weakness for stocks rather unscathed is certainly telling of the relentless demand, despite the fact that the risk-reward, broadly, is not very attractive. The start of the best six months of the year for stocks is around three weeks away and there is a need from a seasonal perspective to ramp up risk exposure at some point.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite