Put-call ratio jumping to the highest level in over a year as traders enact hedges ahead of Tuesday’s Presidential Election.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks slipped slightly to start the week as traders focus their sights on the uncertainties surrounding the US Presidential Election on Tuesday and the Fed rate decision on Thursday. The S&P 500 Index closed down by just less than three-tenths one percent, remaining below the 20-day moving average (5804) that was at the end of last week and testing the rising 50-day moving average (5703) as support. A level of resistance remains in place between Thursday’s open at 5775 and Wednesday’s close at 5816. The short-term trend can been deemed to be negative as investors show caution ahead of election day. Despite the recent stall, this market is not showing any broader topping setups and there remains greater evidence of support than resistance over an intermediate-term timeframe, presenting characteristics of a bullish trend that remains enticing for the positive seasonal tendencies ahead. The concern to the prevailing path, however, is the waning of upside momentum with MACD negatively diverging from price since the end of last year, highlighting the fading enthusiasm towards the risk profile that equities encompass. The short-term pullback is providing us with an entry point to the strength that is normal of the equity market through the last couple of months of the year. We continue to like the groups that are on our list of Accumulate candidates, but there are certainly segments of the market to Avoid. With the start of the best six months of the year for stocks slated to get underway, we are seeking to use weakness to ramp up risk exposure, preferably when metrics of volatility/fear alleviate their rising path that has evolved over the past few months (see our commentary of the Volatility Index (VIX) in our November monthly report).

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

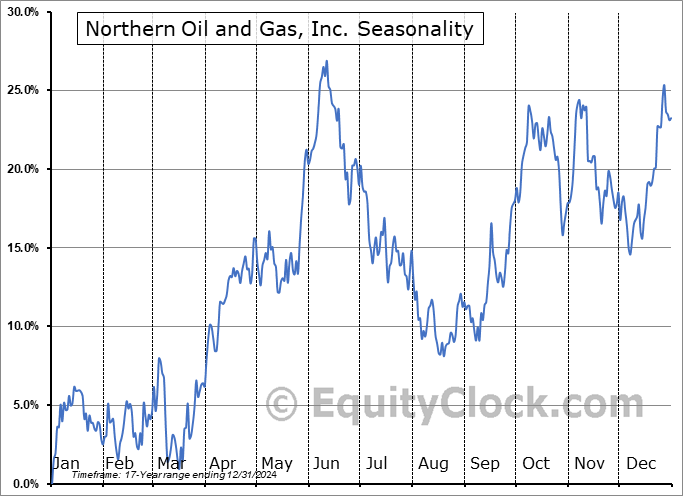

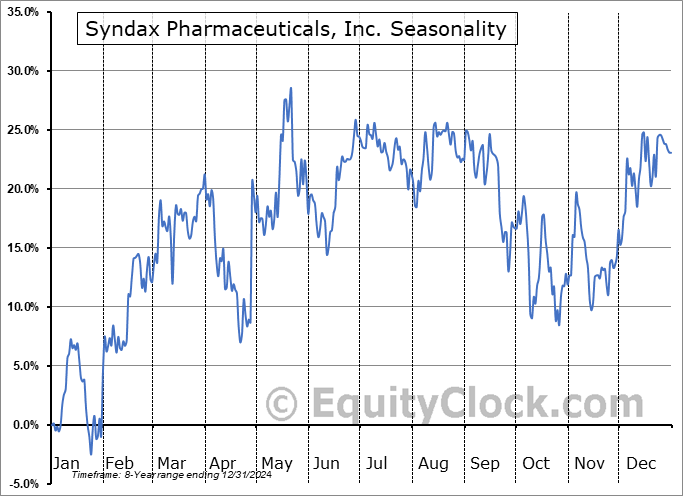

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite