Continue to scrutinize positions against 20-week moving averages; those deriving resistance at the hurdle warrant mitigating, while those holding it as support warrant a positive bias.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

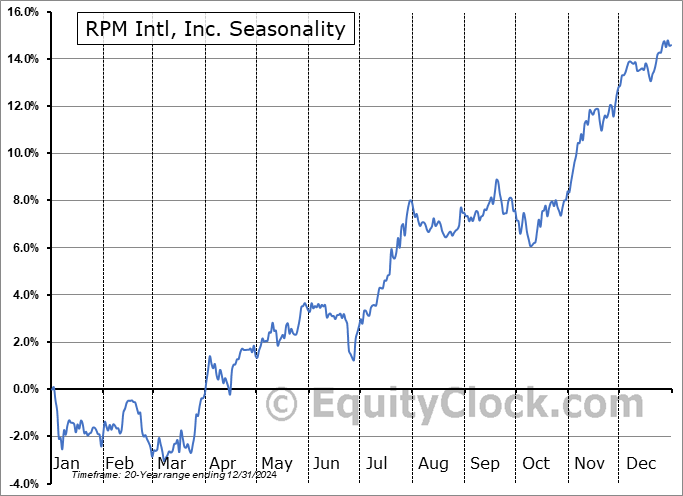

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks continued to claw back from the losses that were derived during the Santa Claus rally period as institutional money managers returned to their desks and began to put money to work. The S&P 500 Index ended up by 0.55% in the first Monday of 2025, pushing slightly above the 50-day moving average (5948) that the benchmark has been clinging to in recent days, providing a rather neutral position for the intermediate-term trend. The benchmark remains above the previous level of horizontal support at the open gap charted following the US Election at 5850. A head-and-shoulders topping pattern can continue to be picked out based on the declines produced in recent weeks, but, given the low volume environment that the market has been within during this holiday timeframe, the significance of this topping setup is certainly diminished. The bearish pattern proposes a downside target of 5670, which was the level of resistance from this past summer’s high. Neckline support at 5850 would have to be definitively broken, first, to achieve the downside potential that the pattern suggests. More important is the resistance that is derived at the 20-day moving average, sufficient to raise concern. Should major moving averages increasingly derive points of resistance, reason to conclude the shift of trend would be provided. Our list of candidates in the market to Accumulate and to Avoid remains appropriately positioned at this seasonally strong time of year, but our Avoid list has been growing in recent weeks given the fading of the election euphoria in the market and we would not be surprised to see it expand beyond this first full week of the year once start of the year fund inflows are allocated.

Want to know which areas of the market to buy or sell? Our Weekly Chart Books have just been updated, providing a clear Accumulate, Avoid, or Neutral rating for currencies, cryptocurrencies, commodities, broad markets, and subsectors/industries of the market. Subscribers can login and click on the relevant links to access.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite