Last year, both initial and continued jobless claims showed the highest level for the end of December since 2020, showing an abnormal calendar year increase that is reminiscent of a pre-recessionary period.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

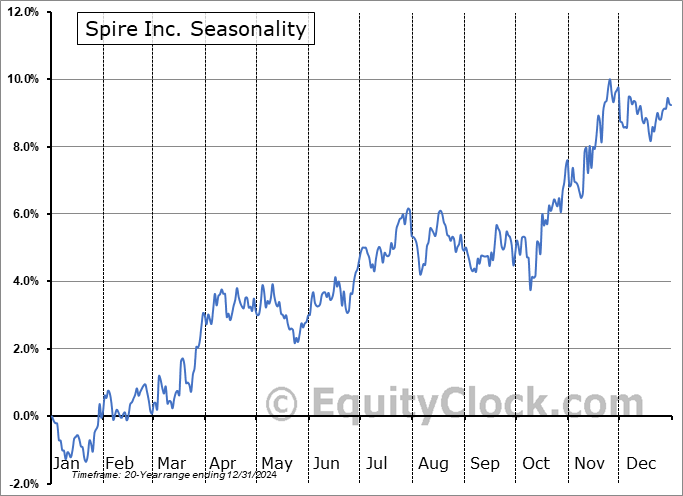

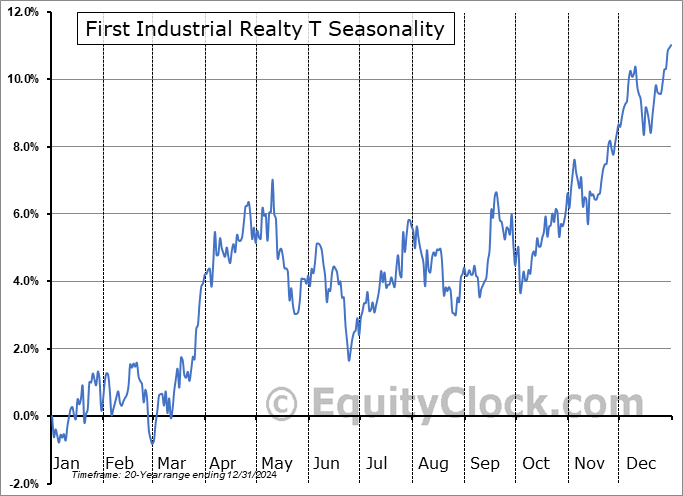

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Note: Thursday is a National Day of Mourning in the US for former President Jimmy Carter. As a result, US equity markets are closed in homage Carter's memory on the day of his funeral. Our next reports will therefore be released on Friday when markets reopen.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks traded fairly flat on Wednesday, continuing to receive their cues from the fluctuations in the US Dollar and treasury yields. The S&P 500 Index ended up by 0.16% on Wednesday, remaining below resistance at the 20-day moving average (5972). The benchmark is back to interacting with the 50-day moving average (5952) that it has been clinging to in recent days, providing a rather neutral position for the intermediate-term trend. The benchmark remains above the previous level of horizontal support at the open gap charted following the US Election at 5850. A head-and-shoulders topping pattern can continue to be picked out based on the declines produced in recent weeks, but, previously, the low volume environment that the market has been within during the holiday timeframe provided little of significance to this topping setup. Tuesday’s session with money managers back in the driver’s seat certainly provides something to heighten the caution that the bearish pattern proposes. The setup points to a downside target of 5670, which was the level of resistance from this past summer’s high. Neckline support at 5850 would have to be definitively broken, first, to achieve the downside potential that the pattern suggests. Superseding any patterns that can be picked out is just the mere appearance that resistance, such as around the 20-day moving average, is starting to have a greater influence than support. Reason to conclude the shift of trend is starting to be provided. We continue to scrutinize the potential impact of this evolving shift on our list of candidates in the market to Accumulate and to Avoid and we would not be surprised to see our list of candidates in the market to Avoid expand following this first full week of the year once start of the year fund inflows are allocated.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite