The market is rallying as a result of the suggestion of a calming of inflationary pressures, but we are seeing this burden on consumer and businesses ramping up. We examine ways to take advantage of this shift.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks jumped on Wednesday as the market cheered the perception of a calming of inflationary pressures in the economy (at least according to the headline change of CPI ex-food and energy) and reacted positively to earnings from the big banks. The S&P 500 Index gained 1.83%, moving above horizontal support that was broken on Friday at 5850 and retracing back to resistance around the 20-day moving average (5933). The benchmark remains below short-term declining trendline resistance at 5975, a hurdle that the benchmark has persisted below over the past month. While Wednesday’s move seems to diminish the threat that the head-and shoulders pattern on the chart was portraying previous, it has not been taken off the table. Horizontal support at 5850 presents the neckline to the topping pattern, a bearish setup that proposes a downside target of 5670. Superseding any patterns that can be picked out is just the mere appearance that resistance, such as around the 20-day moving average, is starting to have a greater influence than support. Reason to conclude the shift of trend has been provided. We continue to scrutinize the potential impact of this evolving shift on our list of candidates in the market to Accumulate and to Avoid and we are expecting that our list will show more of a neutral appearance through the weeks ahead as segments that were previously noted as Accumulate candidates fall off and areas to Avoid are added.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

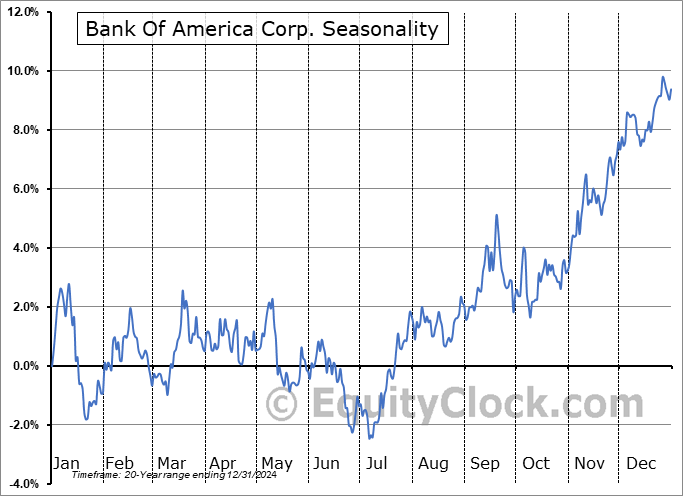

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite