Housing activity has been strained to start the year and this is taking a toll on the stocks with exposure.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks slipped on Thursday as a disappointing reaction to earnings from Walmart (WMT) and ongoing tariff concerns had traders on edge. The S&P 500 Index closed lower by just over four-tenths of one percent, still maintaining levels slightly above the 6100 hurdle that acted as a cap to upside momentum over the past couple of months. The benchmark is managing to remain resilient above the 20-day moving average (6073), despite the apparent loss of excitement to buy around present heights. Momentum indicators have negatively diverged from price since the middle of last year, highlighting the waning enthusiasm investors had been expressing towards tech-heavy (Mag-7) benchmarks, like this, amidst extreme valuations. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we have adopted more of a neutral stance as segments that were previously noted as Accumulate candidates fall off (eg. Technology) and as areas to Avoid are added.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

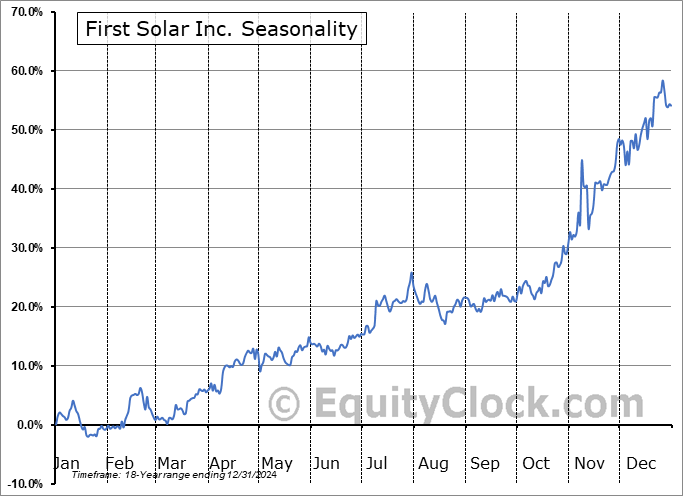

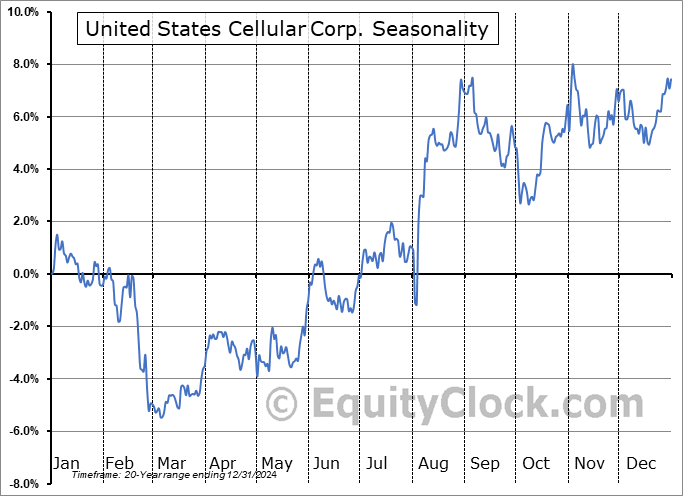

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite