While stocks are currently showing strain, one of the strongest months of the year for performance is directly ahead: The S&P 500 Index has averaged a return of 1.7% in April with a gain frequency of 72%.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

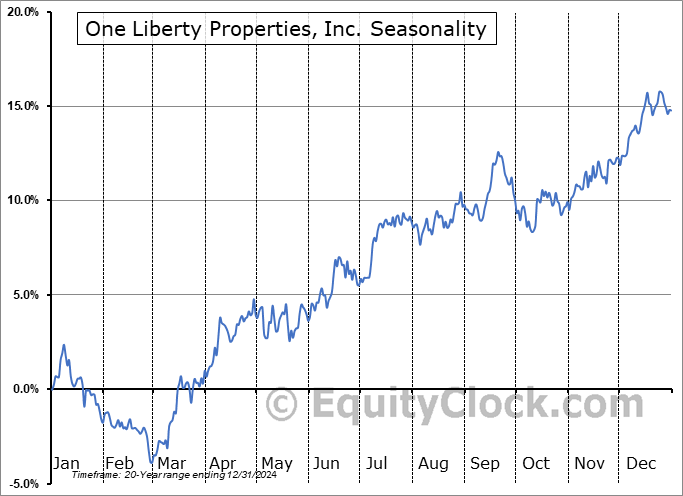

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

A hotter than expected read of inflationary pressures in the economy and another drop in consumer sentiment weighed on the equity market during Friday’s session, derailing the normally upbeat performance that stocks typically realize into quarter-end. The S&P 500 Index dropped by nearly two percent, falling firmly back below long-term support around the 200-day moving average (5759) and violating an ultra-short-term point of support at 5600. Gap support charted on Monday around 5700 has failed, providing the suggestion that the near-term oversold bounce in the market into quarter-end has come to an end. The next point to watch on the downside is, quite obviously, the mid-March low at 5500. A check-back of the now declining resistance at the 50-day moving average (5900) has been our base case, but headline risks are proving to be too high at the present time for this reflux higher to stick. This week, the benchmark failed around 5748, which is the 38.2% Fibonacci retracement level of the February/March pullback and the inability for the benchmark to get above this hurdle on this bounce characterizes a very weak recovery, indicative of a market that wants to move lower (below the lows that were charted around 5500). We are still in this period of seasonal strength that runs through the end of March and into the month of April, therefore there is a bias to give this favourable timeframe the benefit of the doubt; the more likely time to see a resumption of the declining intermediate-term path for stocks is through the off-season that starts in May. We are not going to make any changes to our Super Simper Seasonal Portfolio, yet, following our tactical positioning to take advantage of the positivity that surrounds the end of the quarter, but we are cognizant that the intermediate-term trajectory that is of most importance to us in our work is becoming increasingly threatened. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we have adopted more of a neutral stance as segments that were previously noted as Accumulate candidates fall off (eg. Technology) and as areas to Avoid are added.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite