The S&P 500 Index has reached our intermediate-term downside target very quickly.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

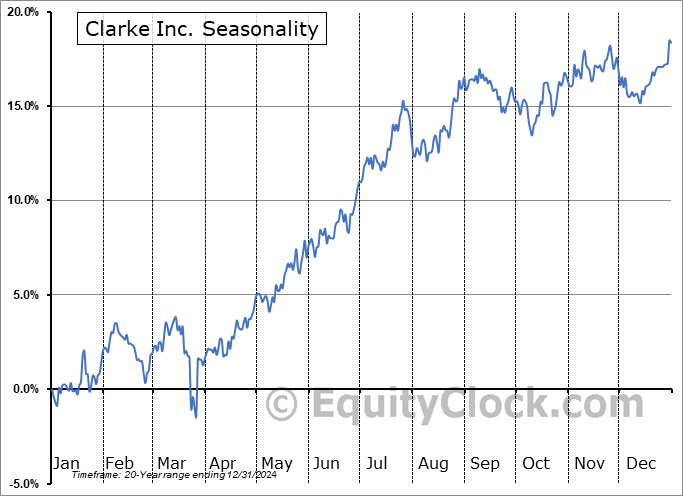

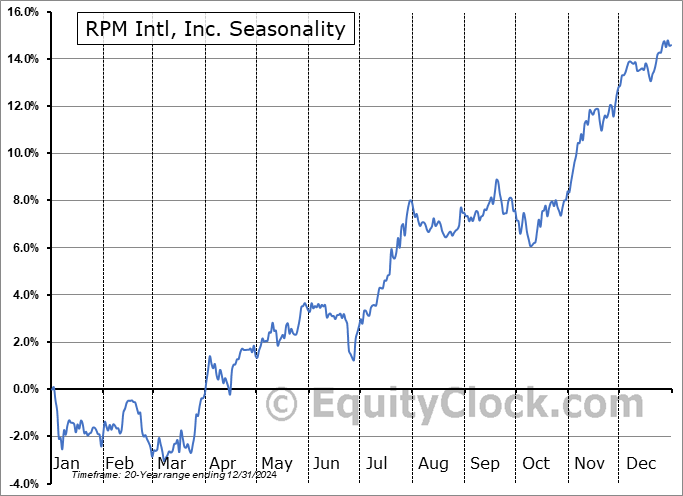

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Another volatile session for stocks as investors scrutinize what impact a tariff war could have on the global economy. After a deeply negative open, the S&P 500 Index closed down by just less than a quarter of one percent as traders attempt to peg a near-term low and cover their shorts. The benchmark remains in a precarious state heading into the second quarter, holding levels below the 200-day moving average, a variable hurdle that traditionally provides a reasonable dividing line between long-term bullish and bearish trends. The prospects of a check-back of the declining resistance at the 50-day moving average (~5823) has not been taken off the table, but headline risks, obviously, have to be contended with in the very near-term; the pace of downside acceleration in this intermediate-term moving average seems likely to catch up with price faster than any upbeat level that could have been foreseen of it previous. We are still in this period of seasonal strength that runs through the month of April, therefore we are biased to let this favourable timeframe show what it is capable of; the more likely time to see the next evolution of the declining intermediate-term path for stocks is through the off-season that starts in May. We have not made any changes to our Super Simple Seasonal Portfolio, yet (as painful as it has been over the past few days given our intermediate-term neutral bias that has been desired), following our tactical positioning to take advantage of the positivity that surrounds the end of the quarter, but we are cognizant that the multi-month path of stocks (most importance to us in our work) is under significant threat. We continue to monitor the potential impact of the apparent rotation in the market on our list of candidates in the market to Accumulate and to Avoid and we have peeled back some of our Avoid listed candidates given how stretched to the downside that prices have become.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite