Impact of the US debt downgrade is filtering in, pushing the 30-Year T-Yield above 5% and resulting in a rollover of the US Dollar.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

The rebound rally in the equity market stemming from the April lows is starting to show signs of stall, resulting in the first negative session for the S&P 500 Index since the deescalation of the US tariff fight with China just over a week ago. The large-cap benchmark closed down by just less than four-tenths of one percent, reacting to a band of resistance between 5900 and 6100, effectively the all-time highs. The implied cap over this market in the range between 5500 and 5800 (corresponding with the span of the cloud of major moving averages) has been broken and it will now be looked to as a zone of support on a subsequent pullback. The short-term trend stemming from the April low is positive, but the intermediate-term path (which is of most importance to us in our seasonal approach) remains under threat, particularly with nothing that burdened the equity market previous adequately solved. We continue to like the way our list of candidates in the market to Accumulate or to Avoid is positioned and we remain on the lookout for new opportunities, either on the long or short side, heading through this off-season for stocks. On the seasonal timeline, the foreseeable threat to stocks is the mean reversion move lower that is common through the middle of June as quarter-end portfolio rebalancing is enacted. We can consider strategy around that event closer to the timeframe.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

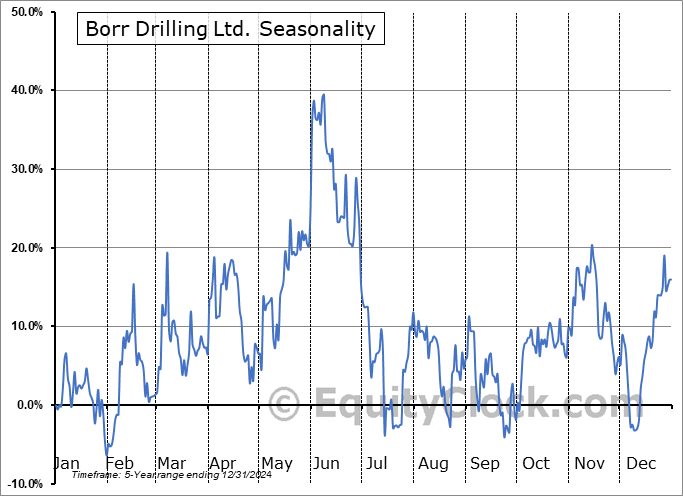

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite