Pre-tariff front-running has come to an end and the consumer is showing evidence of pulling back.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks retreated on Tuesday as concerns pertaining to escalated tensions between Israel and Iran ramped up again, resulting in a rollover of the short-term trend. The S&P 500 Index closed down by just over eight-tenths of one percent, erasing the prior day's gain and continuing to react to the band of resistance between 5900 and 6100. A negative divergence of MACD and RSI that has been recorded since May 20th highlights upside exhaustion, lending itself to a pullback that is quite normal, regardless of the reason, at this time of year. Support at the now rolling over 20-day moving average (5949) is an important line in the sand given that it has remain unviolated throughout the bull-market rally from the April lows. The first of the two timeframes that account for the bulk of the weakness for the offseason for stocks is upon us, running from June 14th to June 27th, therefore adding new risk exposure at this point is not opportune, but things look setup to provide opportunities to add risk exposure before the month concludes. Our list of candidates in the market that are worthy to Accumulate or Avoid remains appropriately positioned, keeping investors tuned into those segments of the market that are working, while highlighting those groups that are not.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

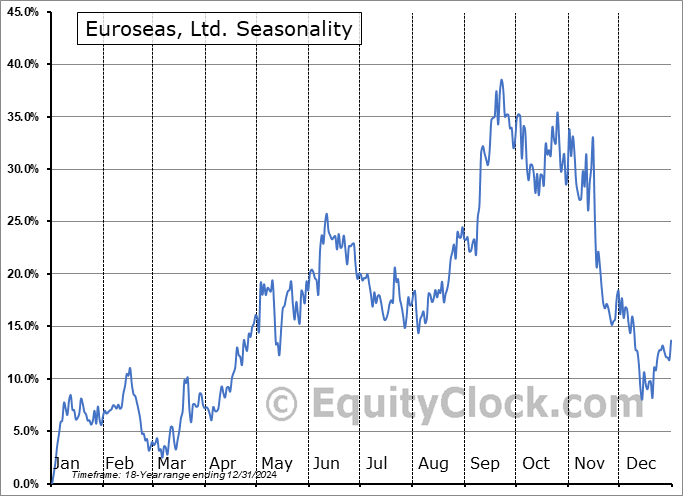

Seasonal charts of companies reporting earnings today:

S&P 500 Index

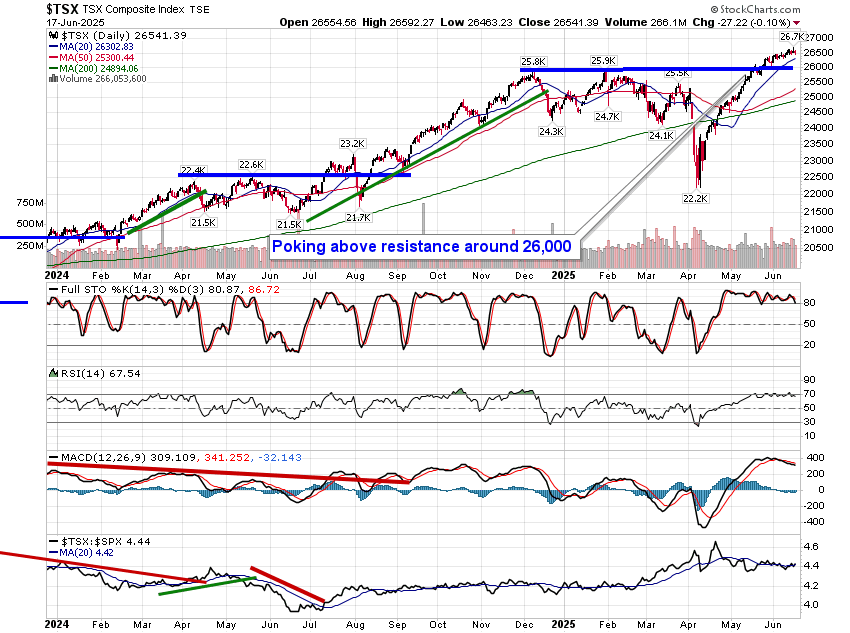

TSE Composite