Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

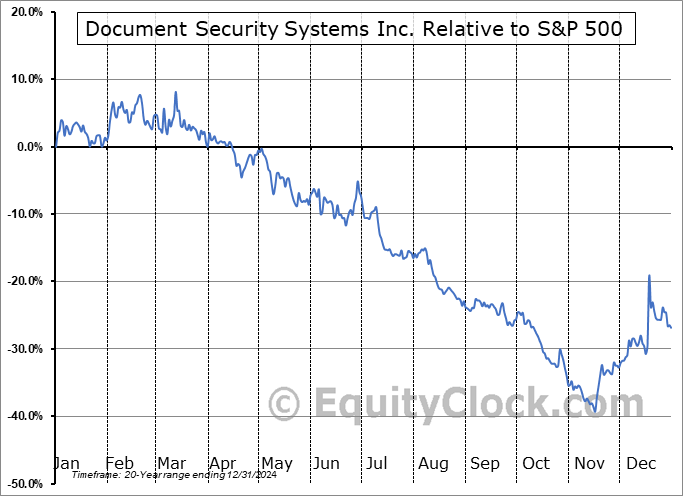

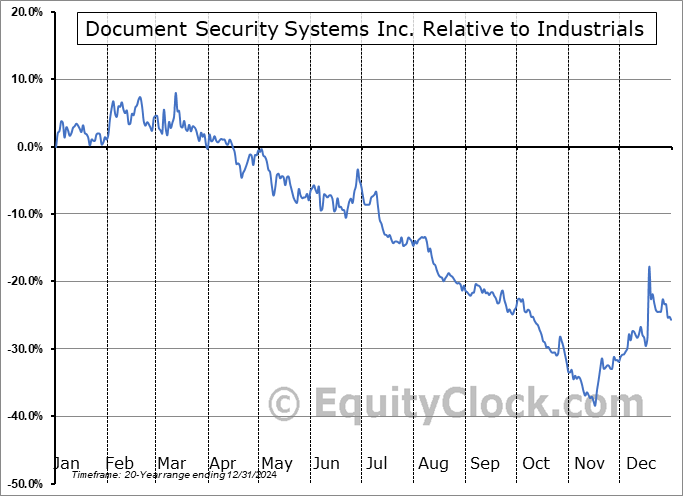

Document Security Systems Inc. (AMEX:DSS) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Document Security Systems Inc. (AMEX:DSS) seasonal charts above shows that a Buy Date of November 16 and a Sell Date of February 20 has resulted in a geometric average return of 2.08% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 11 of those periods. This is a fair rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 102.08% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

DSS, Inc. engages in the development and distribution of paper products designed to protect valuable information from unauthorized scanning, copying, and digital imaging. It operates through the following segments: Product Packaging, Commercial Lending, Biotechnology, Direct Marketing, and Securities and Investment Management. The Product Packaging segment operates in the paper board folding carton, smart packaging, and document security printing markets. The Commercial Lending segment provides commercial loans and on acquiring equity positions in undervalued commercial bank(s), bank holding companies and non-banking licensed financial companies operating in the United States, Southeast Asia, Taiwan, Japan, and South Korea. The Biotechnology segment invests in or acquires companies in the bio-health and bio-medical fields, including businesses focused on the advancement of drug discovery and prevention, inhibition, and treatment of neurological, oncological, and immune related diseases. The Direct Marketing segment provides services to assist companies in the emerging growth big business model of peer-to-peer decentralized sharing marketplaces. The Securities and Investment Management segment develops and acquires assets and investments in the securities trading and funds management arena and to pursue, among other product and service lines, real estate investment funds, broker dealers and mutual funds management. The company was founded in May 1984 and is headquartered in West Henrietta, NY.

To download DSS seasonal chart data, please log in or Subscribe.

To download DSS seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: DSS

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|