Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

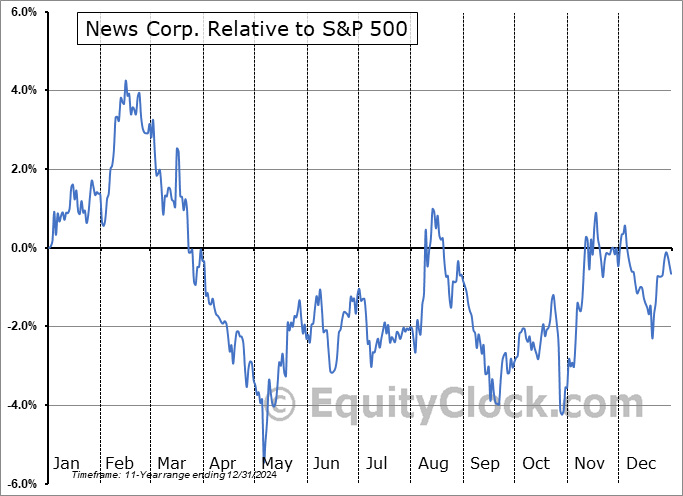

News Corp. (NASD:NWS) Seasonal Chart

Seasonal Chart Analysis

Analysis of the News Corp. (NASD:NWS) seasonal charts above shows that a Buy Date of November 21 and a Sell Date of February 14 has resulted in a geometric average return of 2.98% above the benchmark rate of the S&P 500 Total Return Index over the past 12 years. This seasonal timeframe has shown positive results compared to the benchmark in 9 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 12 years by an average of 10.06% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

News Corp. is diversified media and information services company, which engages in the business of creating and distributing authoritative and engaging content and other products and services to consumers and businesses. It operates through the following segments: Digital Real Estate Services, Subscription Video Services, Dow Jones, Book Publishing, News Media, and Other. The Digital Real Estate Services segment is involved in the operations of the REA Group. The Subscription Video Services segment provides sports, entertainment, and news services to pay-TV and streaming subscribers and other commercial licensees. The Dow Jones segment offers content and data through a variety of owned and off-platform media channels including newspapers, newswires, websites, mobile apps, newsletters, magazines, proprietary databases, live journalism, video, and podcasts. The Book Publishing segment focuses on HarperCollins which publishes and distributes consumer books globally through print, digital, and audio formats. The News Media segment includes the operations of News Corp Australia, News UK, and the New York Post. The Other segment consists of corporate overhead expenses, strategy costs, and costs related to the newspaper matters. The company was founded by Keith Rupert Murdoch in 1979 and is headquartered in New York, NY.

To download NWS seasonal chart data, please log in or Subscribe.

To download NWS seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: NWS

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|