Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

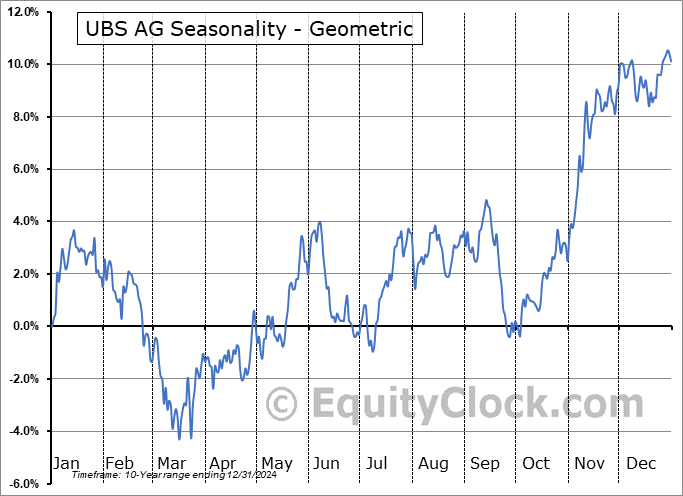

UBS AG (NYSE:UBS) Seasonal Chart

Seasonal Chart Analysis

Analysis of the UBS AG (NYSE:UBS) seasonal charts above shows that a Buy Date of October 18 and a Sell Date of January 18 has resulted in a geometric average return of 7.97% above the benchmark rate of the S&P 500 Total Return Index over the past 10 years. This seasonal timeframe has shown positive results compared to the benchmark in 9 of those periods. This is an excellent rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 10 years by an average of 7.66% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Financial sector, which runs from November 22 to April 13. The seasonal chart for the broad sector is available via the following link: Financial Sector Seasonal Chart.

UBS Group AG is a holding company, which engages in the provision of financial management solutions. It operates through the following segments: Global Wealth Management, Personal and Corporate Banking, Asset Management, Investment Bank, Non-Core and Legacy, and Group Items. The Global Wealth Management segment involves the provision of advice and solutions and offers investment management, estate planning and corporate finance, banking products and services. The Personal and Corporate segment focuses on offering retirement, financing, investments and strategic transactions through its branch network and digital channels. The Asset Management segment consists of capabilities and styles, and advisory support. The Investment Bank segment includes research, advisory services, facilitating clients raising debt and equity from the public, private, and capital markets, cash and derivatives trading. The Non-Core and Legacy segment refers to assets and liabilities prior to the acquisition. The Group Items segment consists of Technology, Corporate Services, Human Resources, Finance, Legal, Risk Control, Compliance, Regulatory and Governance, Communications and Branding, Group Sustainability and Impact, Chief Strategy Office, and Group Treasury. The company was founded on June 29, 1998 and is headquartered in Zurich, Switzerland.

To download UBS seasonal chart data, please log in or Subscribe.

To download UBS seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: UBS

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|