Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

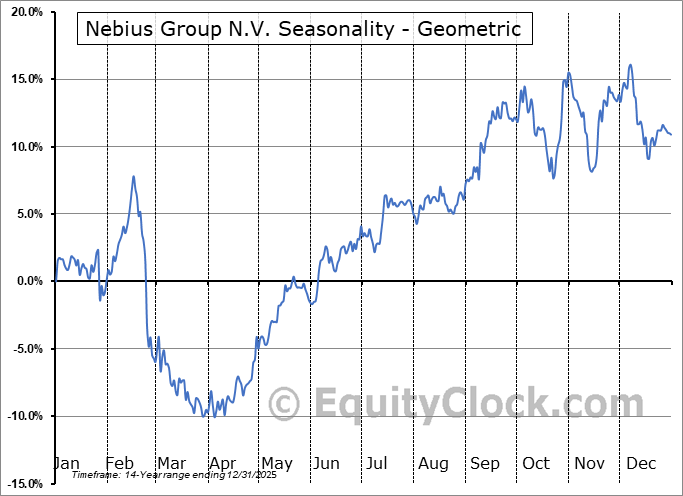

Nebius Group N.V. (NASD:NBIS) Seasonal Chart

Seasonal Chart Analysis

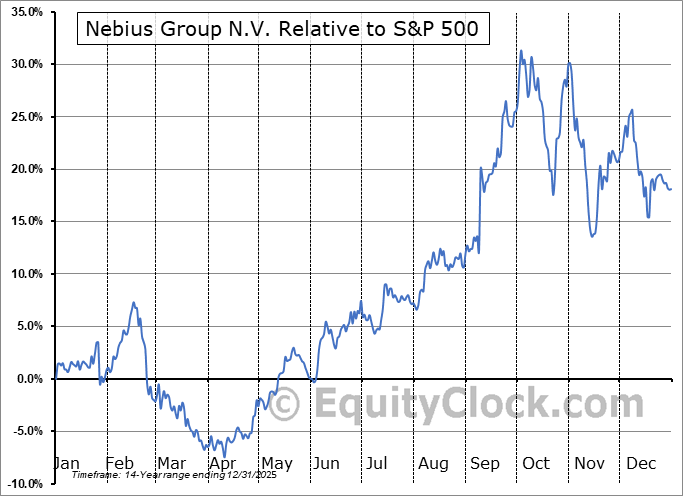

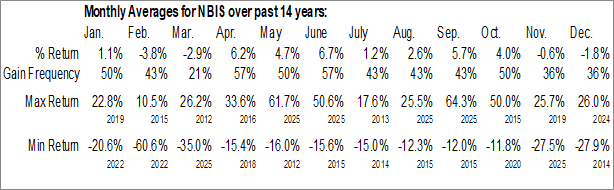

Analysis of the Nebius Group N.V. (NASD:NBIS) seasonal charts above shows that a Buy Date of April 26 and a Sell Date of September 15 has resulted in a geometric average return of 12.59% above the benchmark rate of the S&P 500 Total Return Index over the past 14 years. This seasonal timeframe has shown positive results compared to the benchmark in 10 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 14 years by an average of 15.77% per year.

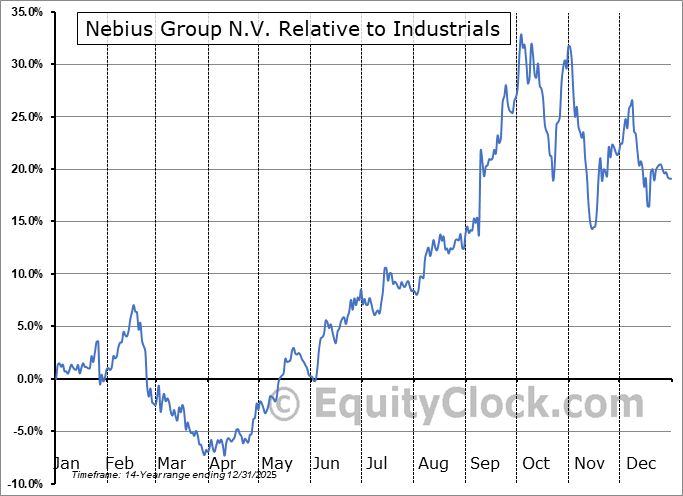

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

Nebius Group NV is a technology company that provides infrastructure and services to AI builders worldwide. It offers Nebius AI, an AI-centric cloud platform provides full-stack infrastructure, including large-scale GPU clusters, cloud services, and developer tools. The company also operates through specialized brands: Toloka AI, which partners in data for generative AI development; TripleTen, an edtech platform focused on re-skilling individuals for tech careers; and Avride, which develops autonomous driving technology. Nebius Group was founded by Elena Kolmanovskaya, Ilya Segalovich, Mikhail Fadeev, and Arkady Volozh in 1989 and is headquartered in Amsterdam, the Netherlands.

To download NBIS seasonal chart data, please log in or Subscribe.

To download NBIS seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: NBIS

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|