Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

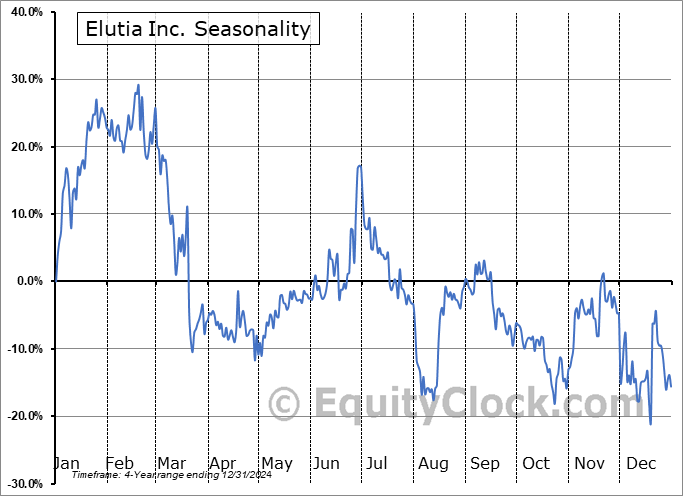

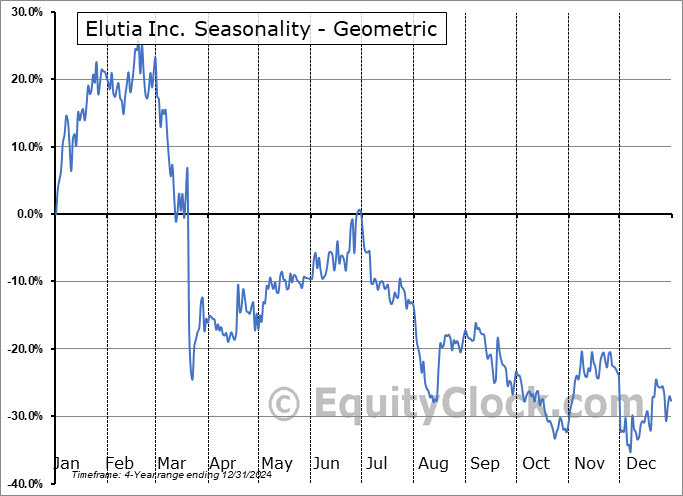

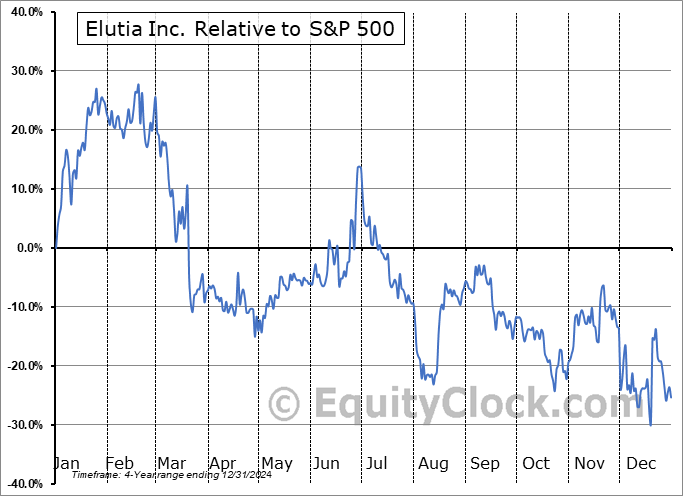

Elutia Inc. (NASD:ELUT) Seasonal Chart

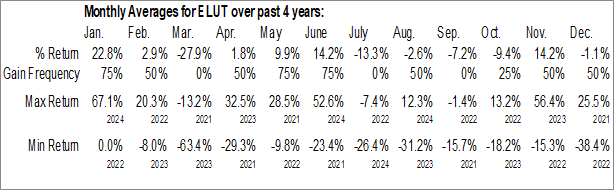

Seasonal Chart Analysis

Analysis of the Elutia Inc. (NASD:ELUT) seasonal charts above shows that a Buy Date of December 7 and a Sell Date of February 26 has resulted in a geometric average return of 23.31% above the benchmark rate of the S&P 500 Total Return Index over the past 5 years. This seasonal timeframe has shown positive results compared to the benchmark in 4 of those periods. This is a very good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 5 years by an average of 75.12% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Healthcare sector, which runs from April 25 to December 4. The seasonal chart for the broad sector is available via the following link: Healthcare Sector Seasonal Chart.

A word of caution: Only 5 years of data is available for shares of ELUT, perhaps insufficient to create a seasonal profile that accurately gauges the seasonal tendencies influencing the investment. Ideally, while 20 years is preferred, at least 10 years of data is required to perform a seasonal analysis that is considered to be reliable for future seasonal periods.

Elutia, Inc. is a biotechnology company, which engages in the provision of biologic products to improve compatibility between medical devices and the patients who need them. It operates through the following segments: Device Protection, Women s Health, and Cardiovascular. The Device Protection segment includes biological envelope that remodels into systematically connected, vascularized tissue for the long-term pocket protection of certain cardiac and neurostimulator implantable electronic vehicles. The Women s Health segment includes pre-hydrated, human acellular dermal matrix, or HADM, that is designed to enable rapid integration, cellular repopulation and rapid revascularization at the surgical site. The Cardiovascular segment includes a variety of viable matrices, produced with a proprietary process that is designed to protect and preserve native bone cells and reduce programmable cell death, for use in bone repair and fusion procedures. The Cardiovascular segment includes a portfolio of extracellular matrices that retain the natural composition of collagen, growth factors and proteins for use in vascular and cardiac repair and pericardial closure. The company was founded by Kevin L. Rakin and Charles Randal Mills on August 6, 2015 and is headquartered in Gaithersburg, MD.

To download ELUT seasonal chart data, please log in or Subscribe.

To download ELUT seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: ELUT

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|