Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

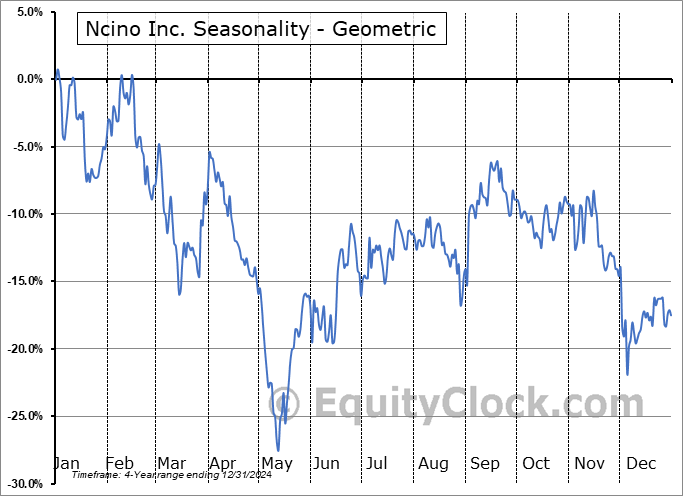

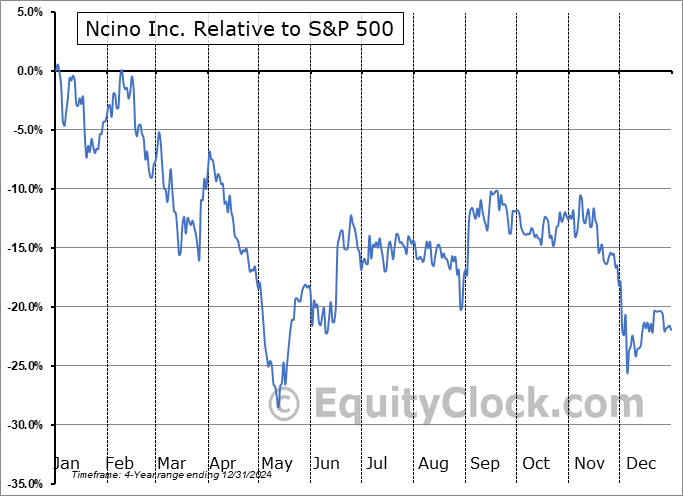

Ncino Inc. (NASD:NCNO) Seasonal Chart

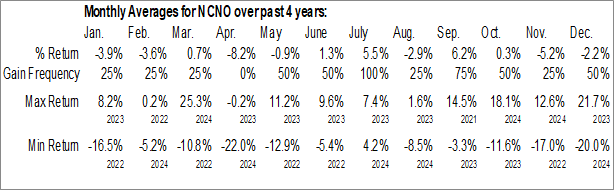

Seasonal Chart Analysis

Analysis of the Ncino Inc. (NASD:NCNO) seasonal charts above shows that a Buy Date of May 12 and a Sell Date of August 7 has resulted in a geometric average return of 11.8% above the benchmark rate of the S&P 500 Total Return Index over the past 5 years. This seasonal timeframe has shown positive results compared to the benchmark in 5 of those periods. This is an excellent rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 5 years by an average of 40.74% per year.

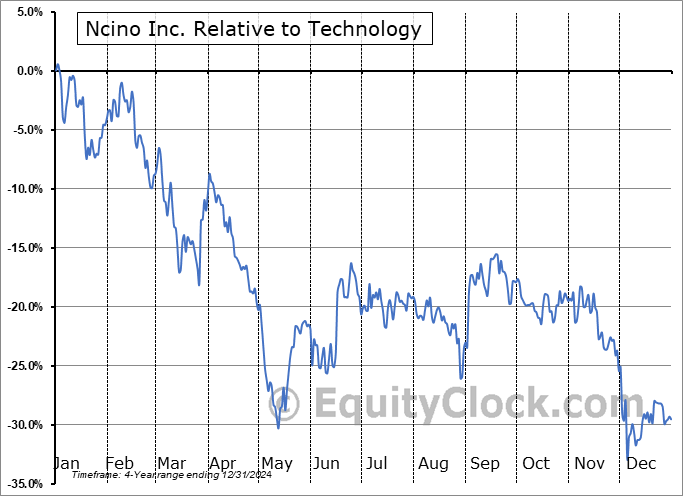

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Technology sector, which runs from October 9 to February 15. The seasonal chart for the broad sector is available via the following link: Technology Sector Seasonal Chart.

A word of caution: Only 5 years of data is available for shares of NCNO, perhaps insufficient to create a seasonal profile that accurately gauges the seasonal tendencies influencing the investment. Ideally, while 20 years is preferred, at least 10 years of data is required to perform a seasonal analysis that is considered to be reliable for future seasonal periods.

nCino, Inc. engages in the provision of cloud-based software applications for financial institutions in the United States and internationally. Its nCino Bank Operating System, a tenant cloud platform, digitizes, automates, and streamlines complex processes and workflow, and utilizes data analytics and artificial intelligence and machine learning (AI/ML) to enable financial institutions to onboard new clients, make loans, and manage the entire loan life cycle, open deposit and other accounts, and manage regulatory compliance. The firm’s nCino IQ is an application suite that utilizes data analytics and AI/ML to provide its customers with automation and insights into their operations, such as tools for analyzing, measuring, and managing credit risk, as well as to enhance their ability to comply with regulatory requirements. The company was founded by Pierre Naud in 2011 and is headquartered in Wilmington, NC.

To download NCNO seasonal chart data, please log in or Subscribe.

To download NCNO seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: NCNO

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|