Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

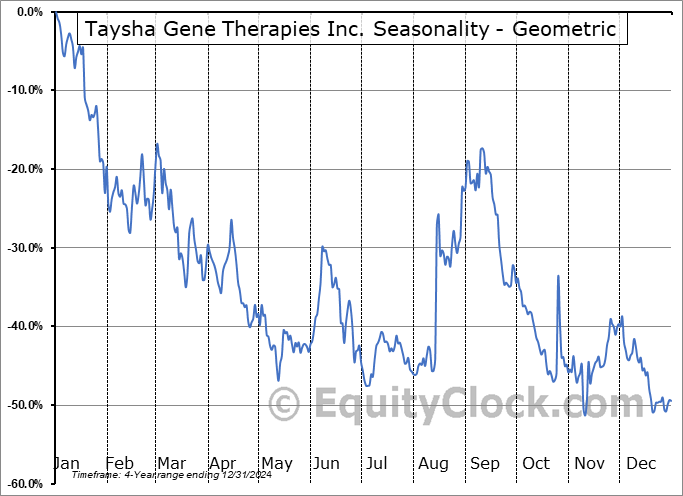

Taysha Gene Therapies Inc. (NASD:TSHA) Seasonal Chart

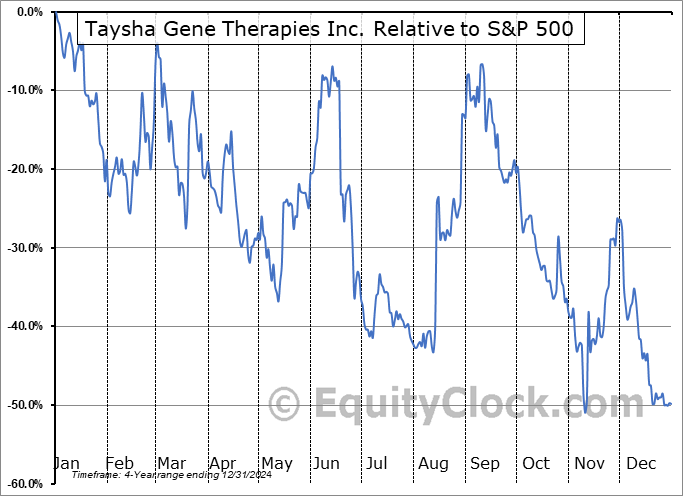

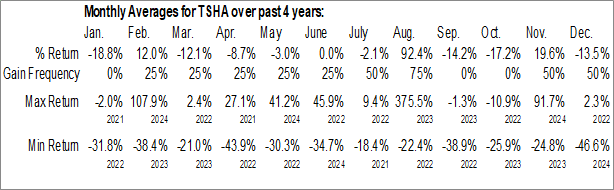

Seasonal Chart Analysis

Analysis of the Taysha Gene Therapies Inc. (NASD:TSHA) seasonal charts above shows that a Buy Date of March 29 and a Sell Date of June 17 has resulted in a geometric average return of 3.19% above the benchmark rate of the S&P 500 Total Return Index over the past 5 years. This seasonal timeframe has shown positive results compared to the benchmark in 4 of those periods. This is a very good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 5 years by an average of 39.34% per year.

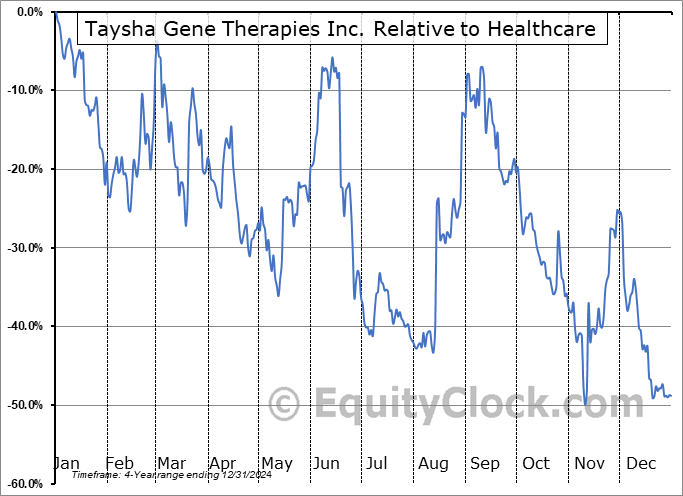

The seasonal timeframe is Inline with the period of seasonal strength for the Healthcare sector, which runs from April 25 to December 4. The seasonal chart for the broad sector is available via the following link: Healthcare Sector Seasonal Chart.

A word of caution: Only 5 years of data is available for shares of TSHA, perhaps insufficient to create a seasonal profile that accurately gauges the seasonal tendencies influencing the investment. Ideally, while 20 years is preferred, at least 10 years of data is required to perform a seasonal analysis that is considered to be reliable for future seasonal periods.

Taysha Gene Therapies, Inc. is a clinical-stage biotechnology company, which engages in the development and commercialization of adeno-associated viruses (AAV) based gene therapies for the treatment of monogenic diseases of the central nervous system. It also develops multiple gene therapy platforms which include AAV9 Discovery, Novel Capsid, and AAV Redosing. The company was founded by Steven Gray, Berge Minassian, and R. A. Session II in 2019 and is headquartered in Dallas, TX.

To download TSHA seasonal chart data, please log in or Subscribe.

To download TSHA seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: TSHA

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|