Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

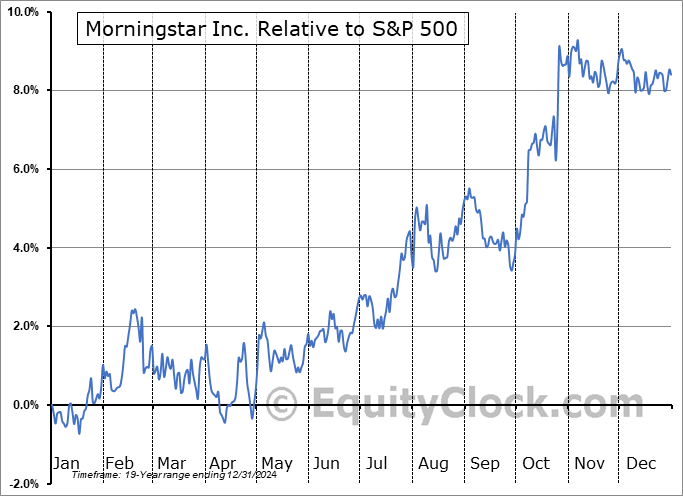

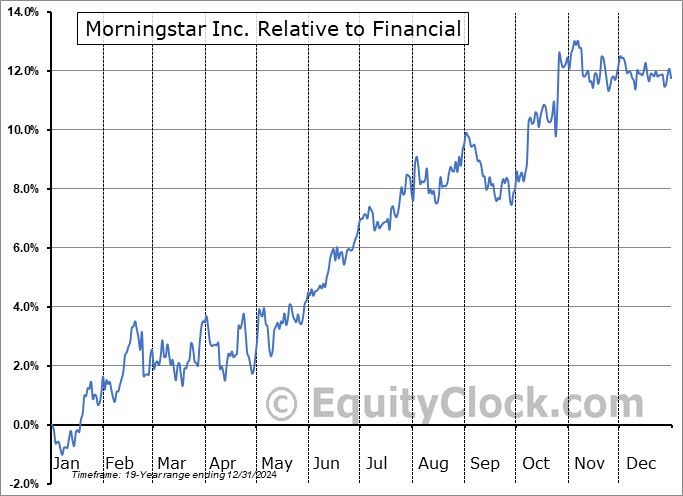

Morningstar Inc. (NASD:MORN) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Morningstar Inc. (NASD:MORN) seasonal charts above shows that a Buy Date of April 29 and a Sell Date of July 29 has resulted in a geometric average return of 2.92% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 14 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 3.55% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Financial sector, which runs from November 22 to April 13. The seasonal chart for the broad sector is available via the following link: Financial Sector Seasonal Chart.

Morningstar, Inc. engages in the provision of investment research. It offers Morningstar data, direct, investment management, advisor workstation, workplace solutions, pitchbook data, enterprise components, research, credit ratings and indexes. It operates through the following segments: Morningstar Data and Analytics, PitchBook, Morningstar Wealth, Morningstar Credit, Morningstar Retirement, and Corporate and All Other. The Morningstar Data and Analytics segment is involved in providing investors data, research and insights, and investment analysis to empower investment decision-making. The PitchBook segment focuses on providing investors with access to a broad collection of data and research covering the private capital markets, including venture capital, private equity, private credit and bank loans, and merger and acquisition activities. The Morningstar Wealth segment refers to model portfolios and wealth platform, practice and portfolio management software for registered investment advisers, data aggregation, enrichment capabilities, and individual investor platform. The Morningstar Credit segment includes credit ratings, research, data, and credit analytics solutions that contribute to the transparency of international and domestic credit markets. The Morningstar Retirement segment offers products designed to help individuals reach retirement goals. The company was founded by Joseph D. Mansueto on May 16, 1984, and is headquartered in Chicago, IL.

To download MORN seasonal chart data, please log in or Subscribe.

To download MORN seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: MORN

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|