Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

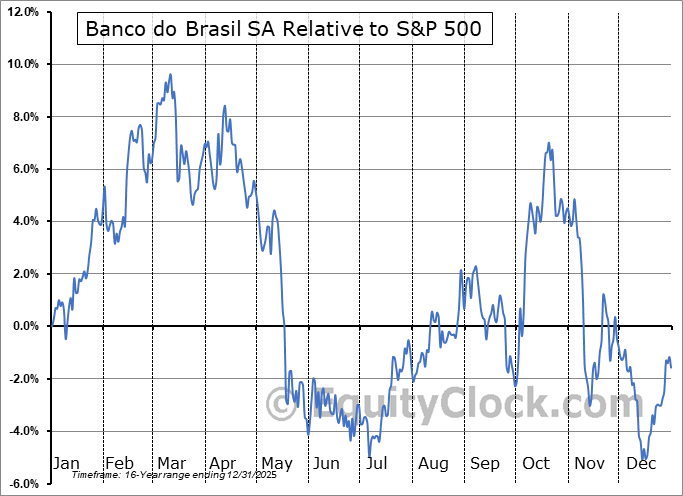

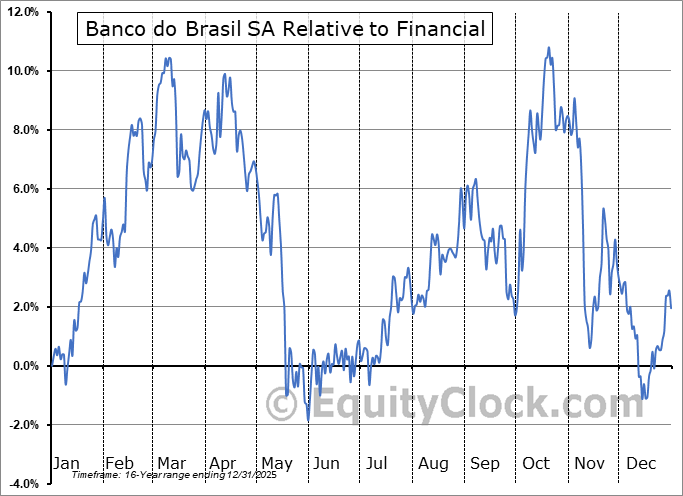

Banco do Brasil SA (OTCMKT:BDORY) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Banco do Brasil SA (OTCMKT:BDORY) seasonal charts above shows that a Buy Date of November 8 and a Sell Date of January 27 has resulted in a geometric average return of 0.04% above the benchmark rate of the S&P 500 Total Return Index over the past 15 years. This seasonal timeframe has shown positive results compared to the benchmark in 11 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 15 years by an average of 12.51% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Financial sector, which runs from November 22 to April 13. The seasonal chart for the broad sector is available via the following link: Financial Sector Seasonal Chart.

Banco do Brasil SA engages in the provision of banking and financial services. It provides solutions, services, and products in the banking, investment, asset management, insurance, social security, premium bonds and payment systems. The firm operates through the following business segments: Banking, Investment, Fund Management, Insurance, Payment Methods, and Others. The Banking segment includes business with the retail, wholesale and government markets, carried out by network and customer service teams, and business with micro-entrepreneurs and the informal sector, performed through banking correspondents. The Investment segment engages in the deals, which are performed in the domestic capital market, with activity in the intermediation and distribution of debts in the primary and secondary markets, as well as equity interest and the rendering of financial services. The Fund Management segment is responsible for operations inherent to the purchase, sale and custody of securities, portfolio management, and management of investment funds and clubs. The Insurance segment is composed of products and services related to life, property and automobile insurance. The Payment Methods segment is responsible for funding, transmission, processing services, and financial settlement of operations in electronic means. The Others segment consists of the operational support and consortium segments such as credit recovery, consortium administration, development, manufacture, commercialization, rent and integration of digital electronic systems and equipment, peripherals, programs, inputs, and computing supplies, intermediation of air tickets, lodging and organization of events. The company was founded on October 12, 1808 and is headquartered in Brasilia, Brazil.

To download BDORY seasonal chart data, please log in or Subscribe.

To download BDORY seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: BDORY

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|