Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

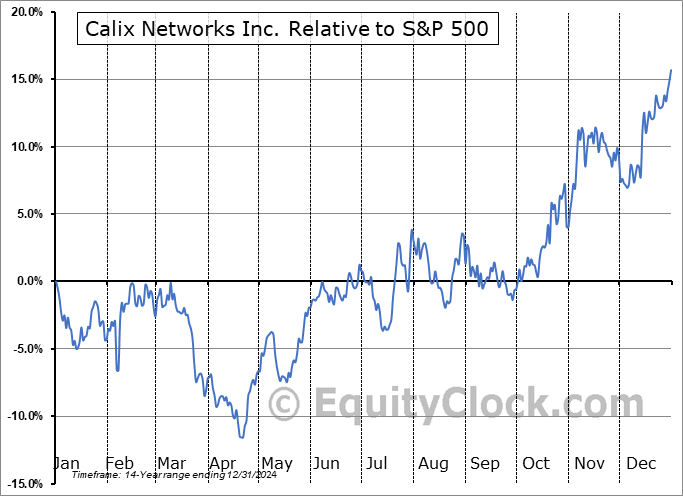

Calix Networks Inc. (NYSE:CALX) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Calix Networks Inc. (NYSE:CALX) seasonal charts above shows that a Buy Date of April 16 and a Sell Date of July 23 has resulted in a geometric average return of 8.44% above the benchmark rate of the S&P 500 Total Return Index over the past 15 years. This seasonal timeframe has shown positive results compared to the benchmark in 11 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 15 years by an average of 13.51% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Technology sector, which runs from October 9 to February 15. The seasonal chart for the broad sector is available via the following link: Technology Sector Seasonal Chart.

Calix, Inc. provides cloud and software platforms, systems and services required to realize the unified access network. The firm offers broadband communications access systems and software for fiber and copper-based network architectures that enable communications service providers to transform their networks and connect to their residential and business subscribers. It enables communication service providers to provide a wide range of revenue-generating services from basic voice and data to advanced broadband services over legacy and next-generation access networks. The firm focuses on communications service providers access networks with the portion of the network, which governs available bandwidth and determines the range and quality of services that can be offered to subscribers. It also develops and sells carrier-class hardware and software products. The company was founded by Michael L. Hatfield and Carl E. Russo in August 1999 and is headquartered in San Jose, CA.

To download CALX seasonal chart data, please log in or Subscribe.

To download CALX seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: CALX

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|