Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

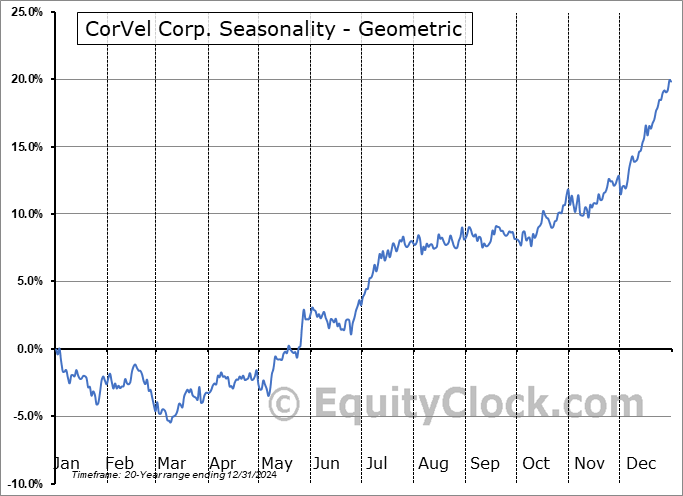

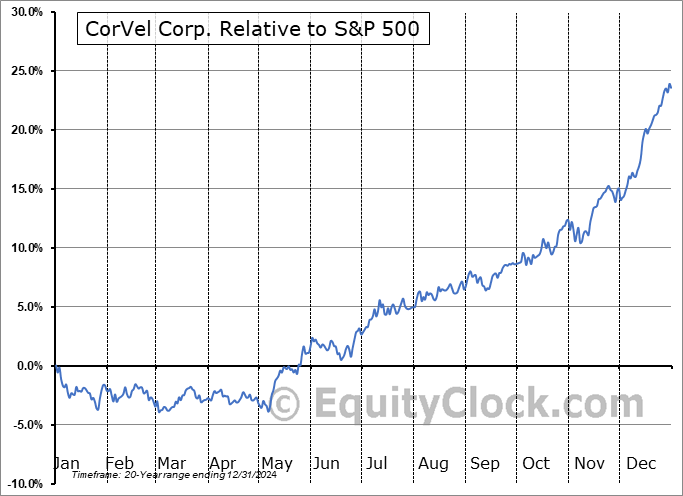

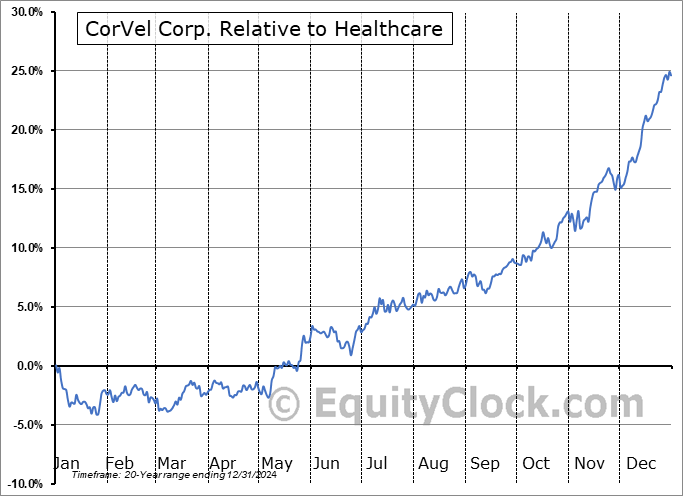

CorVel Corp. (NASD:CRVL) Seasonal Chart

Seasonal Chart Analysis

Analysis of the CorVel Corp. (NASD:CRVL) seasonal charts above shows that a Buy Date of September 27 and a Sell Date of January 1 has resulted in a geometric average return of 7.17% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 17 of those periods. This is a very good rate of success, but the return underperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 0.33% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Healthcare sector, which runs from April 25 to December 4. The seasonal chart for the broad sector is available via the following link: Healthcare Sector Seasonal Chart.

CorVel Corp. engages in the provision of services to employers and payors in the risk management and insurance services arenas, including workers’ compensation, general liability, auto liability, and hospital bill auditing and payment integrity. It operates through the Patient Management Services and Network Solutions Services segments. The Patient Management Services segment includes claims administration, utilization review, medical case management, and vocational rehabilitation. The Network Solutions Services segment consists of fee schedule auditing, hospital bill auditing, coordination of independent medical examinations, diagnostic imaging review services, and preferred provider referral services. The company was founded by V. Clemons Gordon Sr. in 1987 and is headquartered in Fort Worth, TX.

To download CRVL seasonal chart data, please log in or Subscribe.

To download CRVL seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: CRVL

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|