Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

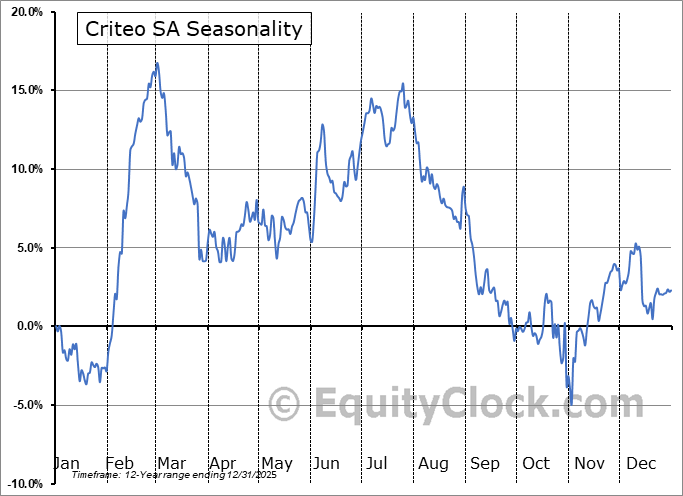

Criteo SA (NASD:CRTO) Seasonal Chart

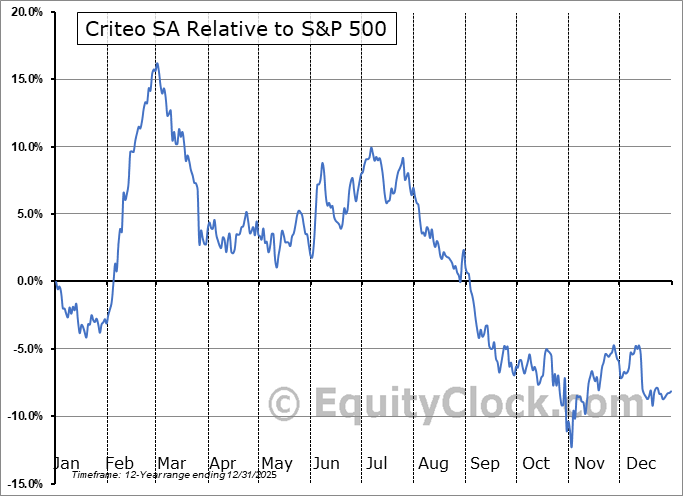

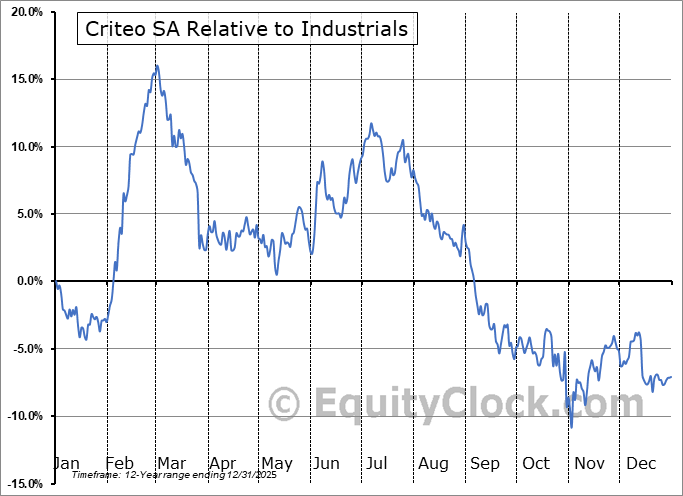

Seasonal Chart Analysis

Analysis of the Criteo SA (NASD:CRTO) seasonal charts above shows that a Buy Date of November 2 and a Sell Date of February 26 has resulted in a geometric average return of 9.49% above the benchmark rate of the S&P 500 Total Return Index over the past 12 years. This seasonal timeframe has shown positive results compared to the benchmark in 9 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 12 years by an average of 24.66% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

Criteo SA is a global technology company, which specializes in digital performance marketing. The firm enables e-commerce companies to leverage large volumes of granular data to engage and convert their customers. It operates through the following segments: Marketing Solutions, Retail Media, and Iponweb. The Marketing Solutions segment is involved in helping advertisers achieve their customer acquisition and retention goals. The Retail Media segment assists retailers in generating high-margin advertising revenues from brands and agencies looking to address multiple marketing goals. The iponweb segment specializes in building real-time advertising technology and trading infrastructure, delivering advanced media buying, selling, and packaging capabilities for media owners, agencies, performance advertisers, and third-party AdTech platforms. The company was founded by Jean-Baptiste Rudelle, Franck Le Ouay, Pascal Gauthier, Laurent Quatrefages and Romain Niccoli on November 3, 2005 and is headquartered in Paris, France.

To download CRTO seasonal chart data, please log in or Subscribe.

To download CRTO seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: CRTO

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|