Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

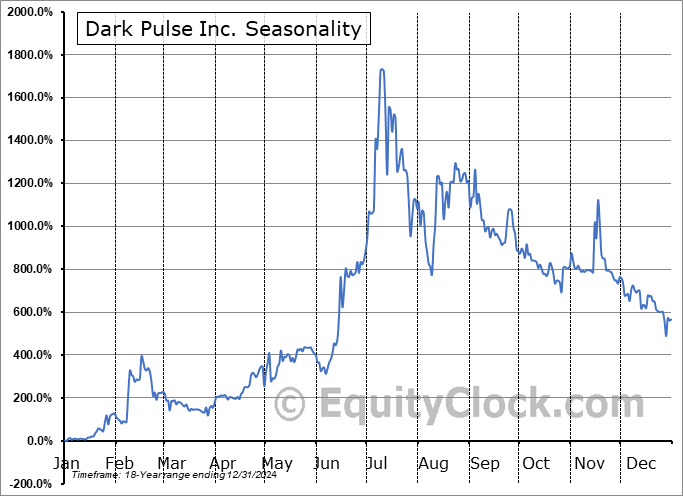

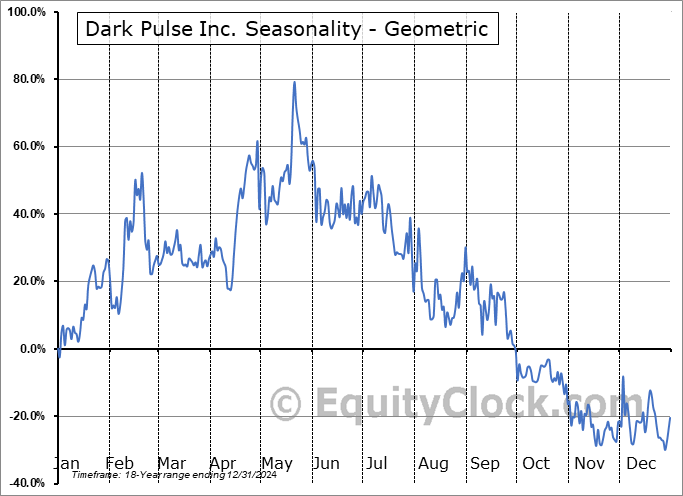

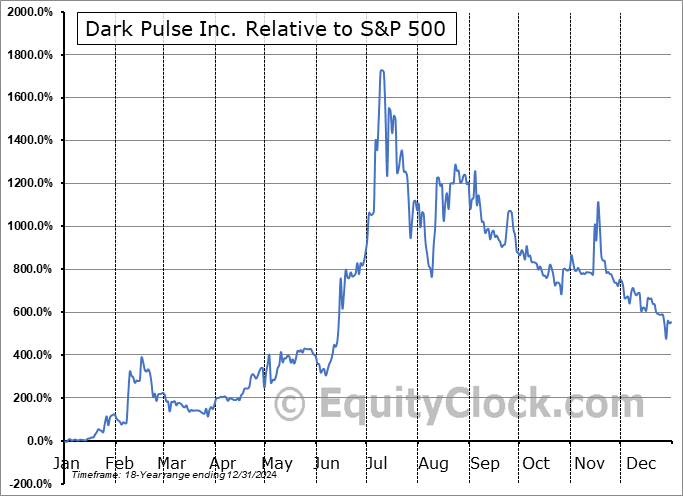

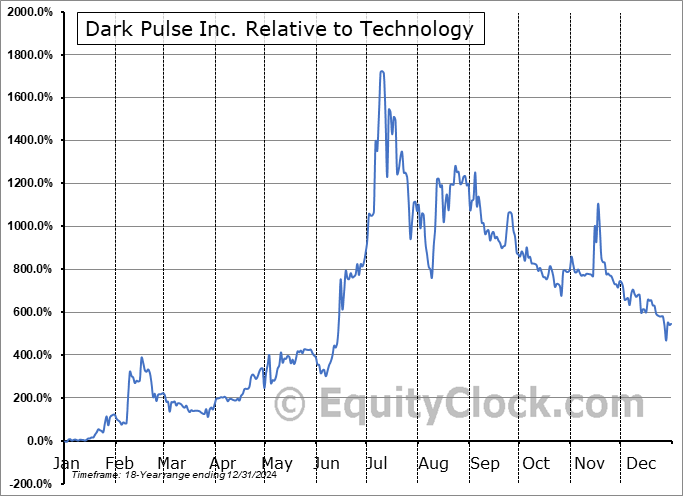

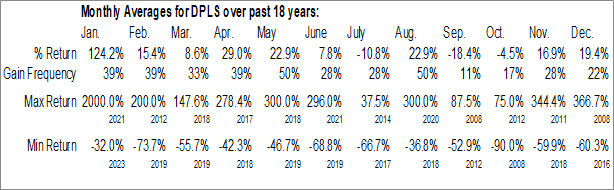

Dark Pulse Inc. (OTCMKT:DPLS) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Dark Pulse Inc. (OTCMKT:DPLS) seasonal charts above shows that a Buy Date of December 29 and a Sell Date of May 21 has resulted in a geometric average return of 90.07% above the benchmark rate of the S&P 500 Total Return Index over the past 18 years. This seasonal timeframe has shown positive results compared to the benchmark in 13 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 18 years by an average of 118.08% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Technology sector, which runs from October 9 to February 15. The seasonal chart for the broad sector is available via the following link: Technology Sector Seasonal Chart.

DarkPulse Inc is a technology-security company. It offers industries and government a full suite of engineering, installation, and security management solutions. The company’s patented BOTDA dark-pulse sensor technology allows for the monitoring of dynamic environments due to its greater resolution and accuracy. It provides a comprehensive data stream of critical metrics for assessing the health and security of infrastructures by detecting wall deformation, corrosion, pressure, strain, & temperature from sensor data collected in real time. DarkPulse products have applications in the following sectors: structural monitoring, temperature sensing, security & defense, and others. Geographically, the company generates key revenue from the United Kingdom and the rest from North America.

To download DPLS seasonal chart data, please log in or Subscribe.

To download DPLS seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: DPLS

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|