Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

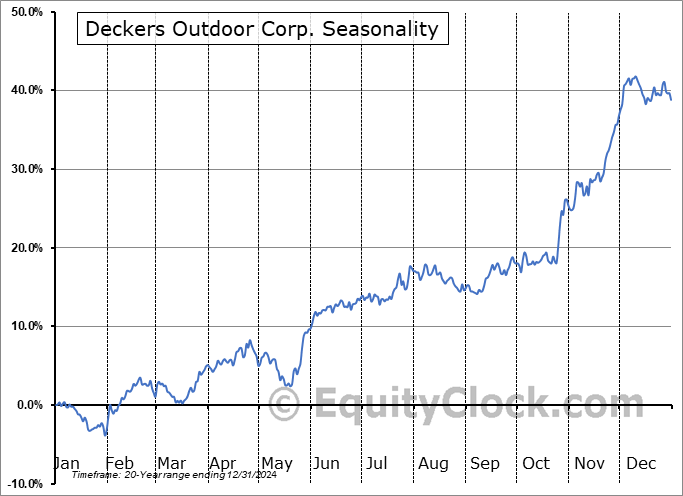

Deckers Outdoor Corp. (NYSE:DECK) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Deckers Outdoor Corp. (NYSE:DECK) seasonal charts above shows that a Buy Date of March 17 and a Sell Date of August 1 has resulted in a geometric average return of 8.66% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 17 of those periods. This is a very good rate of success, but the return underperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 2.19% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Consumer Discretionary sector, which runs from October 17 to April 12. The seasonal chart for the broad sector is available via the following link: Consumer Discretionary Sector Seasonal Chart.

Deckers Outdoor Corp. engages in the business of designing, marketing, and distributing footwear, apparel, and accessories developed for both everyday casual lifestyle use and high performance activities. It operates through the following segments: UGG Brand, HOKA Brand, Teva Brand, Sanuk Brand, Other Brands, and Direct-to-Consumer. The UGG Brand segment offers a line of premium footwear, apparel, and accessories. The HOKA Brand segment sells footwear and apparel that offers enhanced cushioning and inherent stability with minimal weight, originally designed for ultra-runners. The Teva Brand segment focuses on the sport sandal and modern outdoor lifestyle category, such as sandals, shoes, and boots. The Sanuk Brand segment originated in Southern California surf culture and has emerged into a lifestyle brand with a presence in the relaxed casual shoe and sandal categories. The Other Brands segment includes the Koolaburra by UGG brand. The Direct-to-Consumer segment consists of retail stores and e-commerce websites. The company was founded by Douglas B. Otto in 1973 and is headquartered in Goleta, CA.

To download DECK seasonal chart data, please log in or Subscribe.

To download DECK seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: DECK

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|