Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

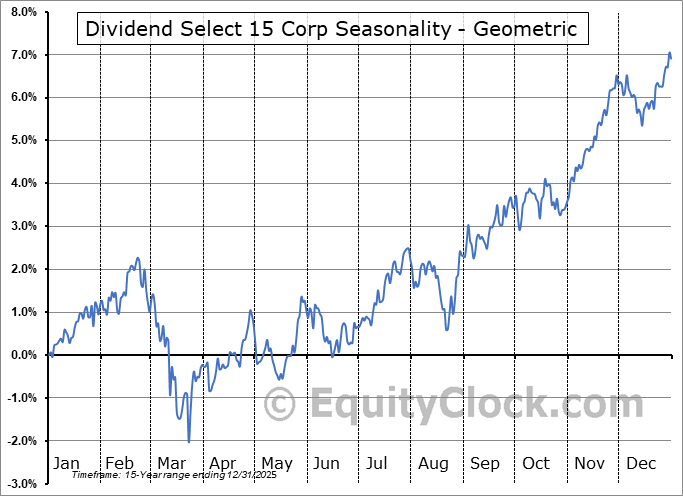

Dividend Select 15 Corp (TSE:DS.TO) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Dividend Select 15 Corp (TSE:DS.TO) seasonal charts above shows that a Buy Date of July 15 and a Sell Date of October 3 has resulted in a geometric average return of 2.21% above the benchmark rate of the S&P 500 Total Return Index over the past 15 years. This seasonal timeframe has shown positive results compared to the benchmark in 11 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 15 years by an average of 8.26% per year.

To download DS.TO seasonal chart data, please log in or Subscribe.

To download DS.TO seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: DS.TO

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|