Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

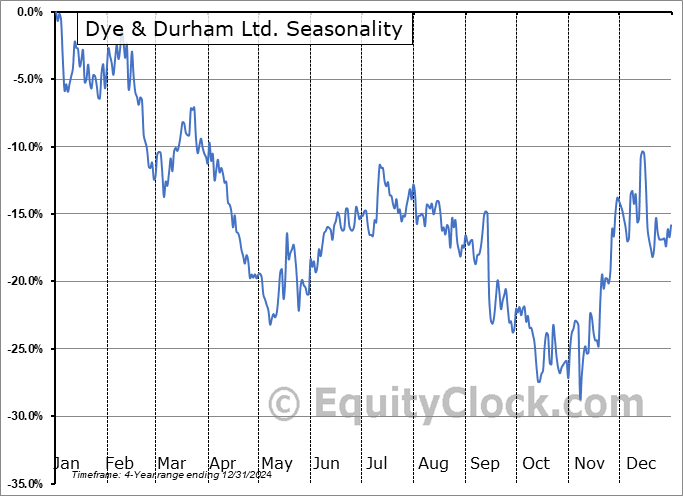

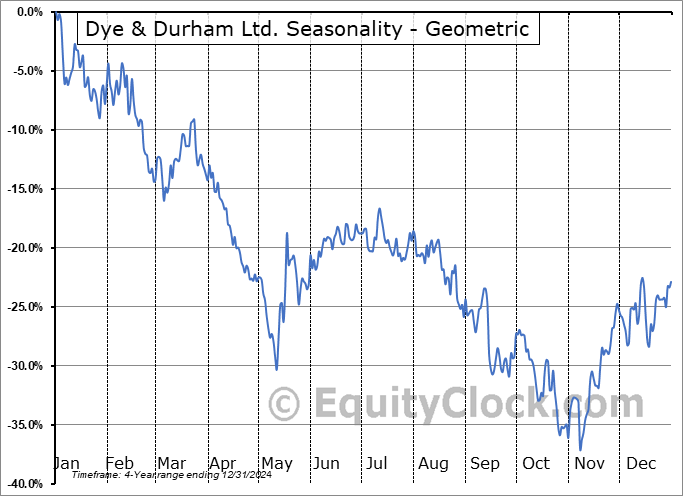

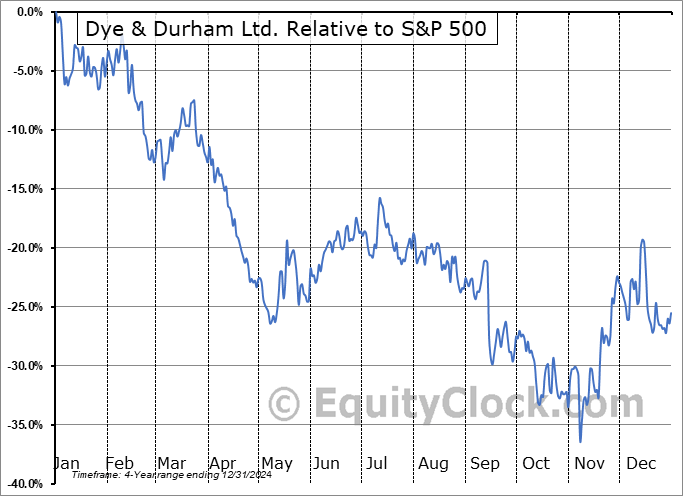

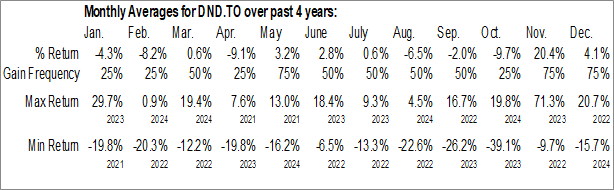

Dye & Durham Ltd. (TSE:DND.TO) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Dye & Durham Ltd. (TSE:DND.TO) seasonal charts above shows that a Buy Date of October 13 and a Sell Date of January 3 has resulted in a geometric average return of 22.73% above the benchmark rate of the S&P 500 Total Return Index over the past 5 years. This seasonal timeframe has shown positive results compared to the benchmark in 5 of those periods. This is an excellent rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 5 years by an average of 69.41% per year.

The seasonal timeframe correlates Fairly Well with the period of seasonal strength for the Technology sector, which runs from October 9 to February 15. The seasonal chart for the broad sector is available via the following link: Technology Sector Seasonal Chart.

A word of caution: Only 5 years of data is available for shares of DND.TO, perhaps insufficient to create a seasonal profile that accurately gauges the seasonal tendencies influencing the investment. Ideally, while 20 years is preferred, at least 10 years of data is required to perform a seasonal analysis that is considered to be reliable for future seasonal periods.

Dye & Durham Ltd. engages in the provision of cloud-based software and technology solutions. It operates through the following geographical segment: Canada, the United Kingdom and Ireland, Australia, and Other. The company was founded in 1874 and is headquartered in Toronto, Canada.

To download DND.TO seasonal chart data, please log in or Subscribe.

To download DND.TO seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: DND.TO

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|