Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

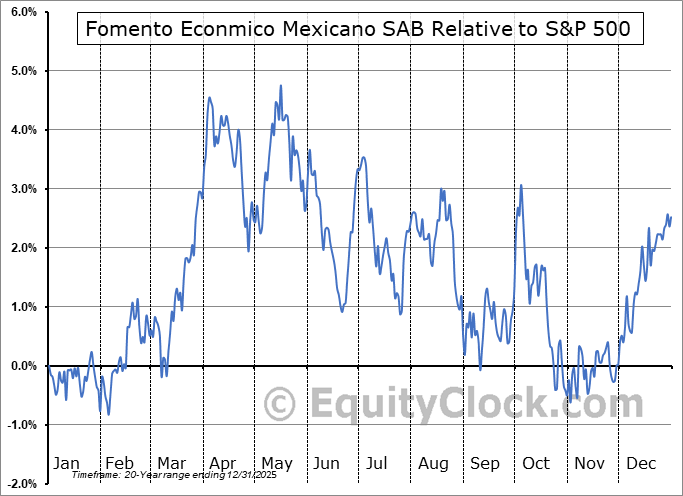

Fomento Econmico Mexicano SAB (NYSE:FMX) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Fomento Econmico Mexicano SAB (NYSE:FMX) seasonal charts above shows that a Buy Date of November 13 and a Sell Date of April 9 has resulted in a geometric average return of 4.09% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 15 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 5.49% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Consumer Staples sector, which runs from April 25 to November 23. The seasonal chart for the broad sector is available via the following link: Consumer Staples Sector Seasonal Chart.

Fomento Economico Mexicano SAB de CV operates as a holding company, which engages in the production, distribution, and marketing of beverages. The firm also produces, markets, sells, and distributes Coca-Cola trademark beverages, including sparkling beverages. It operates through the following segments: Coca-Cola FEMSA, Proximity Americas Division, Proximity Europe Division, Health Division, Fuel Division and Others. The Coca-Cola FEMSA segment produces, markets, sells, and distributes Coca-Cola trademark beverages through standard bottler agreements in the territories where it operates. The Proximity Americas Division segment operates a chain of small-format stores in Mexico. The Proximity Europe Division segment operates a chain of small-box retail and foodvenience in Switzerland, Germany, Austria, Luxembourg and the Netherlands. The Health Division segment involves drugstores and related operations. The Fuel Division segment deals with retail service stations for fuels, motor oils, and other car care products. The Other Business segment involves other companies and corporate activities. The company was founded by Isaac Garza, Jos Calder n, Jos A. Muguerza, Francisco G. Sada, and Joseph M. Schnaider in 1890 and is headquartered in Monterrey, Mexico.

To download FMX seasonal chart data, please log in or Subscribe.

To download FMX seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: FMX

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|