Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

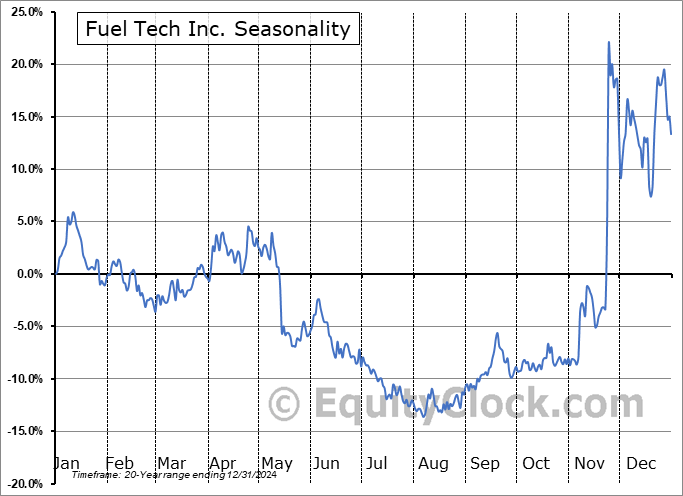

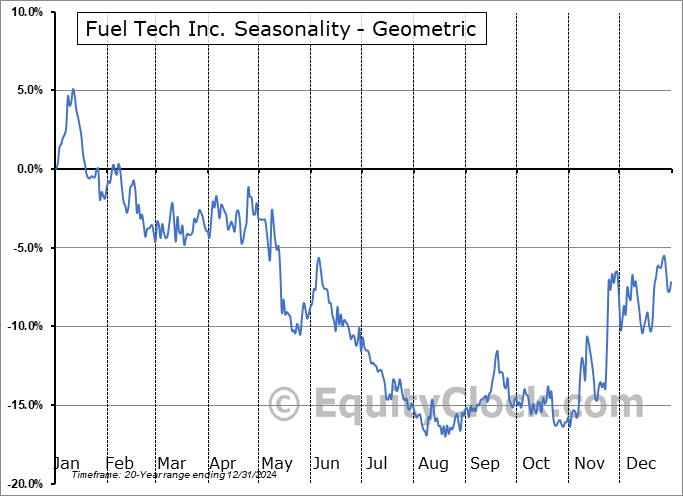

Fuel Tech Inc. (NASD:FTEK) Seasonal Chart

Seasonal Chart Analysis

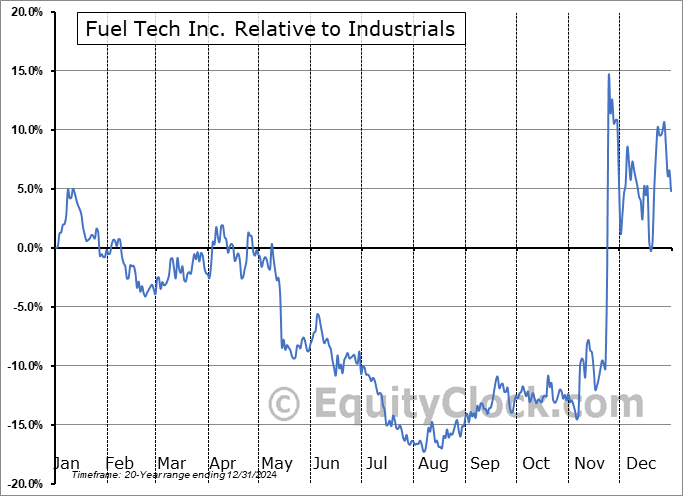

Analysis of the Fuel Tech Inc. (NASD:FTEK) seasonal charts above shows that a Buy Date of October 28 and a Sell Date of January 24 has resulted in a geometric average return of 5.92% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 12 of those periods. This is a fair rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 23.02% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

Fuel Tech, Inc. engages in the development, commercialization and application of proprietary technologies for air pollution control, process optimization, water treatment, and advanced engineering services. It operates through the following segments: Air Pollution Control, Fuel Chem Technologies, and Other. The Air Pollution Control Technology segment includes technologies to reduce nitrogen oxides emissions in flue gas from boilers, incinerators, furnaces, and other stationary combustion sources. The Fuel Chem Technology segment uses chemical processes in combination with computational fluid dynamics, and chemical kinetics modeling boiler modeling, for the control of slagging, fouling, corrosion, opacity, and other sulfur trioxide-related issues in furnaces, and boilers. The Other segment includes those profit and loss items not allocated to either reportable segment. The company was founded by Burr T. Walter in 1987 and is headquartered in Warrenville, IL.

To download FTEK seasonal chart data, please log in or Subscribe.

To download FTEK seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: FTEK

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|