Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

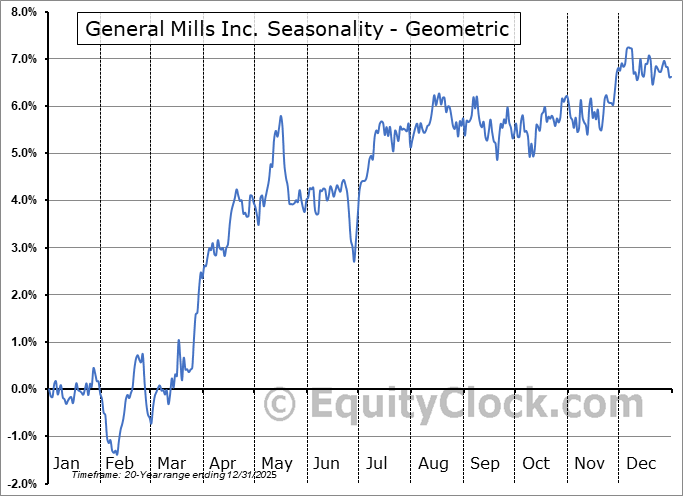

General Mills Inc. (NYSE:GIS) Seasonal Chart

Seasonal Chart Analysis

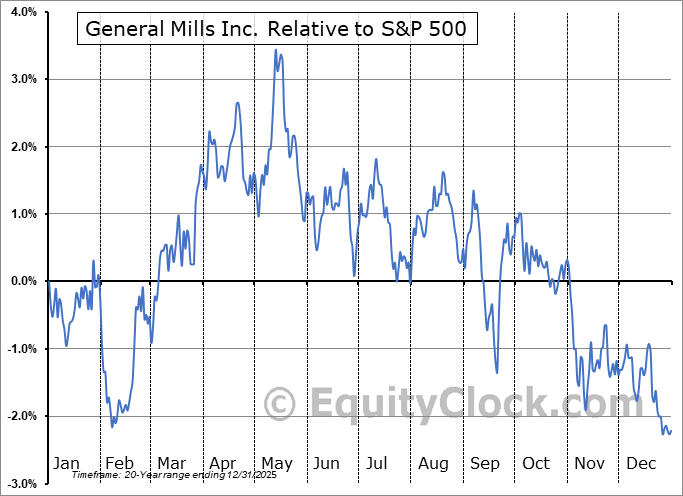

Analysis of the General Mills Inc. (NYSE:GIS) seasonal charts above shows that a Buy Date of February 7 and a Sell Date of May 18 has resulted in a geometric average return of 3.43% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 16 of those periods. This is a very good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 7.22% per year.

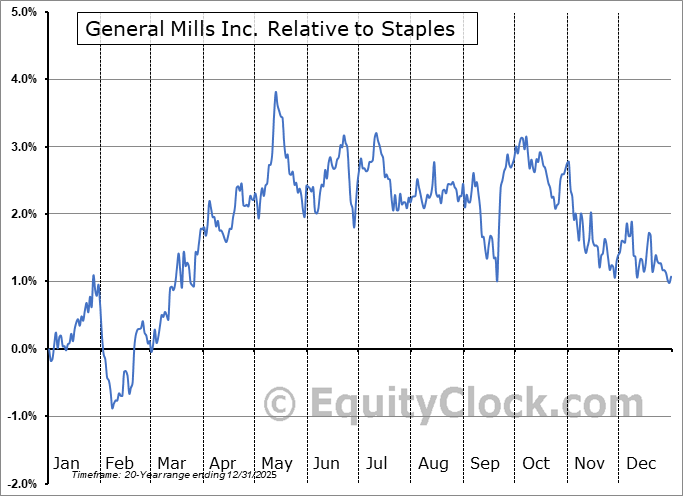

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Consumer Staples sector, which runs from April 25 to November 23. The seasonal chart for the broad sector is available via the following link: Consumer Staples Sector Seasonal Chart.

General Mills, Inc. engages in the manufacture and marketing of branded consumer foods sold through retail stores. Its product categories include snacks, ready-to-eat cereal, convenient meals, pet food, refrigerated and frozen dough, baking mixes and ingredients, yogurt, and ice cream. It operates through the following segments: North America Retail, International, North America Pet, and North America Foodservice. The North America Retail segment includes grocery stores, mass merchandisers, membership stores, natural food chains, drug, dollar and discount chains, convenience stores, and e-commerce grocery providers. The International segment refers to the retail and foodservice businesses outside of the US and Canada. The North America Pet segment includes pet food products sold in national pet superstore chains, e-commerce retailers, grocery stores, regional pet store chains, mass merchandisers, and veterinary clinics and hospitals. The North America Foodservice segment offers ready-to-eat cereals, snacks, refrigerated yogurt, frozen meals, unbaked and fully baked frozen dough products, baking mixes, and bakery flour. The company was founded by Cadwallader C. Washburn on June 20, 1928 and is headquartered in Minneapolis, MN.

To download GIS seasonal chart data, please log in or Subscribe.

To download GIS seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: GIS

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|