Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

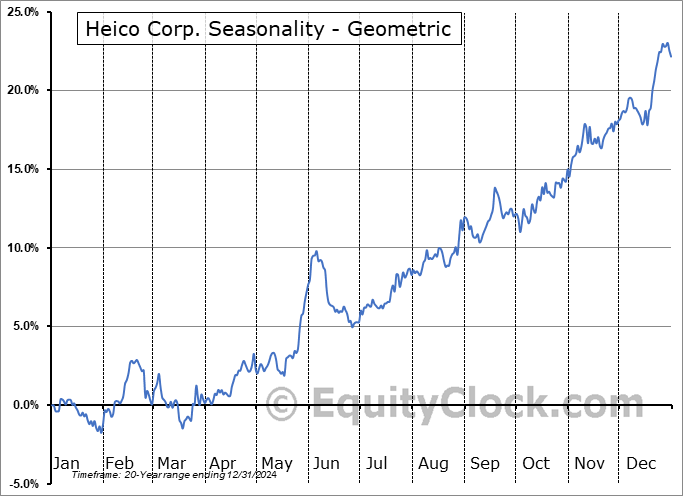

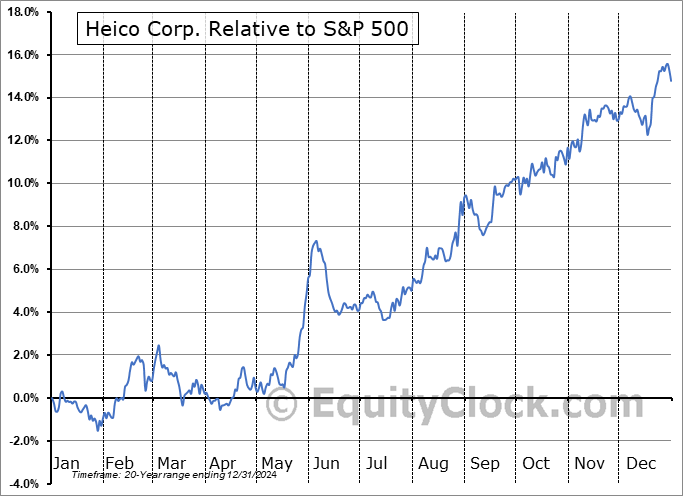

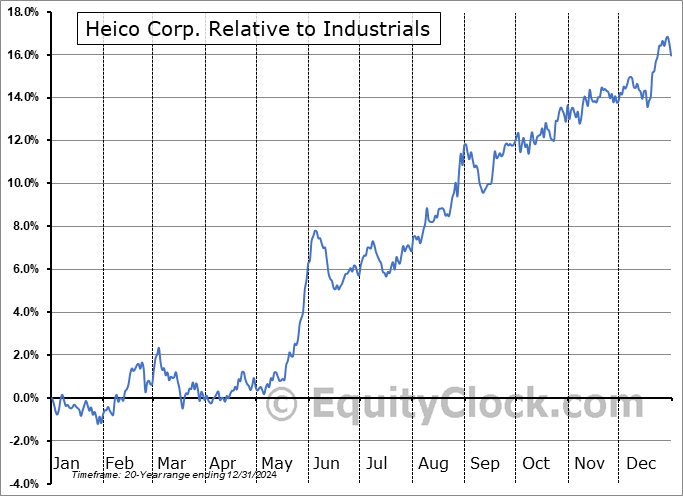

Heico Corp. (NYSE:HEI) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Heico Corp. (NYSE:HEI) seasonal charts above shows that a Buy Date of October 8 and a Sell Date of March 4 has resulted in a geometric average return of 7.26% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 18 of those periods. This is an excellent rate of success, but the return underperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 3.95% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

HEICO Corp. engages in the manufacturing of electronic equipment for the aviation, defense, space, medical, telecommunications, and electronics industries. It operates through the Flight Support Group and Electronic Technologies Group segments. The Flight Support Group segment designs, manufactures, repairs, overhauls, and distributes jet engine and aircraft component replacement parts. The Electronic Technologies Group segment focuses on designing and manufacturing electronic, data and microwave, and electro-optical products, including infrared simulation and test equipment, laser rangefinder receivers, electrical power supplies, back-up power supplies, power conversion products, underwater locator beacons, emergency locator transmission beacons, flight deck annunciators, panels and indicators, electromagnetic and radio frequency interference shielding and filters, high power capacitor charging power supplies, amplifiers, traveling wave tube amplifiers, photo detectors, amplifier modules, microwave power modules, flash lamp drivers, laser diode drivers, arc lamp power supplies, custom power supply designs, cable assemblies, high voltage power supplies, high voltage interconnection devices and wire, high voltage energy generators, high frequency power delivery systems, and memory products. The company was founded in 1957 and is headquartered in Hollywood, FL.

To download HEI seasonal chart data, please log in or Subscribe.

To download HEI seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: HEI

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|