Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

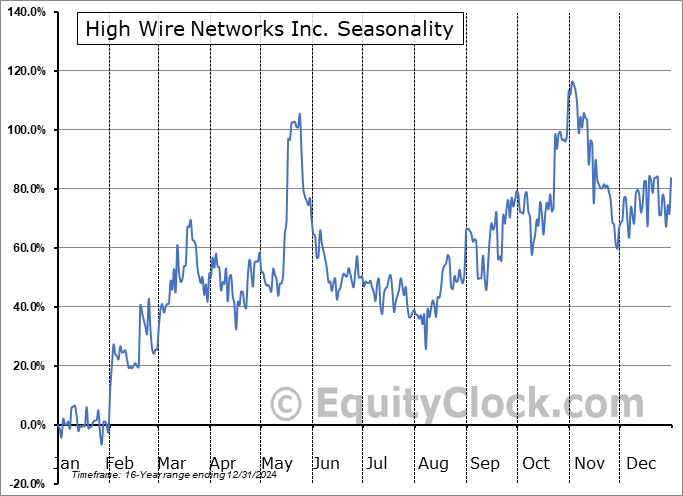

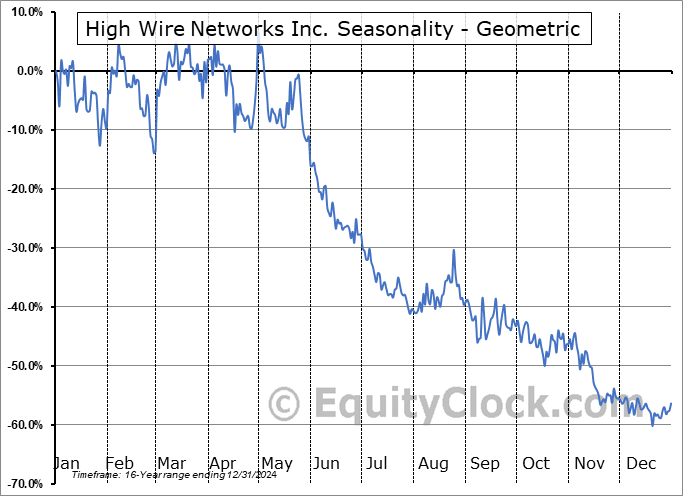

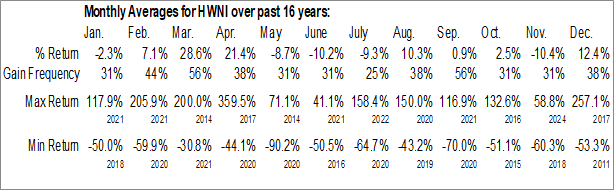

High Wire Networks Inc. (OTCMKT:HWNI) Seasonal Chart

Seasonal Chart Analysis

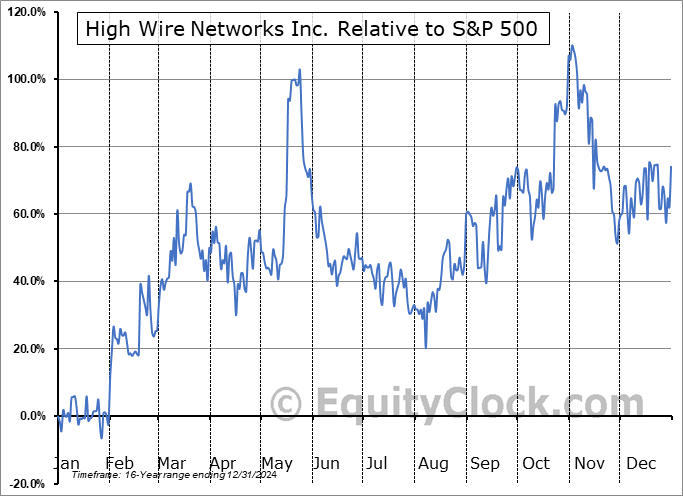

Analysis of the High Wire Networks Inc. (OTCMKT:HWNI) seasonal charts above shows that a Buy Date of January 31 and a Sell Date of May 3 has resulted in a geometric average return of 8.51% above the benchmark rate of the S&P 500 Total Return Index over the past 16 years. This seasonal timeframe has shown positive results compared to the benchmark in 9 of those periods. This is a fair rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 16 years by an average of 108.51% per year.

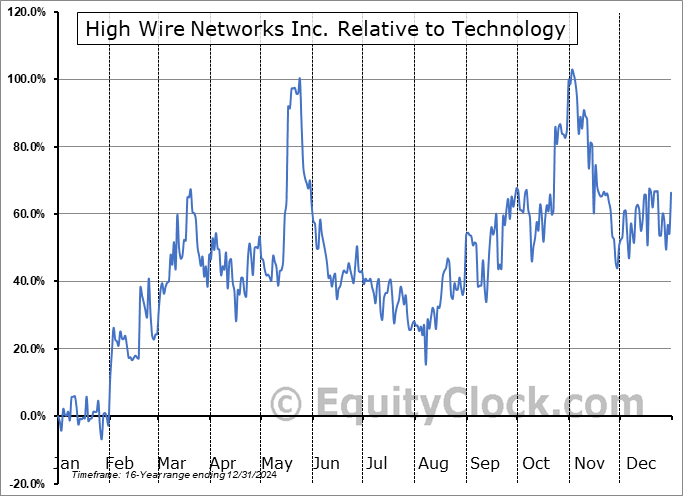

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Technology sector, which runs from October 9 to February 15. The seasonal chart for the broad sector is available via the following link: Technology Sector Seasonal Chart.

High Wire Networks Inc provider of managed cybersecurity, managed networks, and tech-enabled professional services delivered exclusively through a channel sales model. Its Overwatch managed security platform-as-a-service offers organizations end-to-end protection for networks, data, endpoints, and users through multiyear recurring revenue contracts in this fast-growing technology segment.

To download HWNI seasonal chart data, please log in or Subscribe.

To download HWNI seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: HWNI

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|