Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

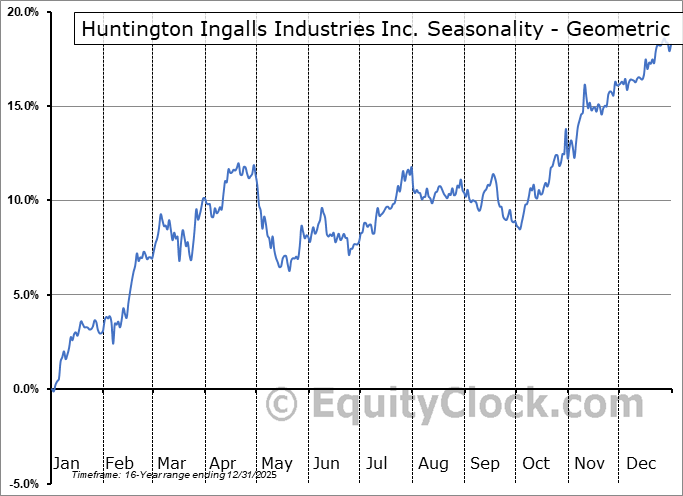

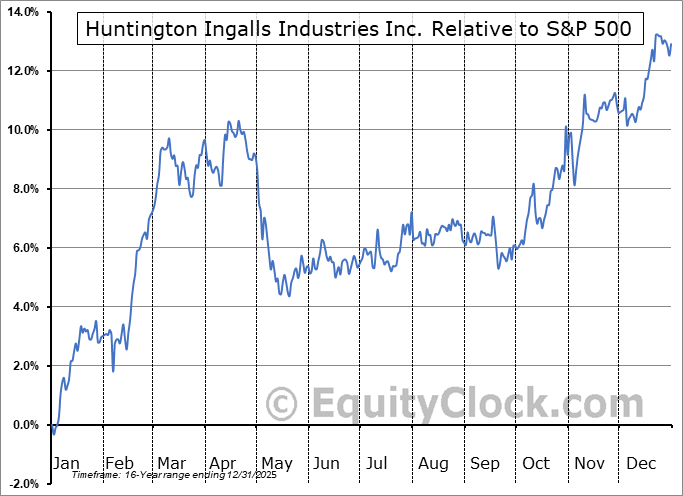

Huntington Ingalls Industries Inc. (NYSE:HII) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Huntington Ingalls Industries Inc. (NYSE:HII) seasonal charts above shows that a Buy Date of December 10 and a Sell Date of April 21 has resulted in a geometric average return of 9.09% above the benchmark rate of the S&P 500 Total Return Index over the past 16 years. This seasonal timeframe has shown positive results compared to the benchmark in 14 of those periods. This is a very good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 16 years by an average of 5.35% per year.

The seasonal timeframe correlates Fairly Well with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

Huntington Ingalls Industries, Inc. engages in the shipbuilding business. It operates through the following business segments: Ingalls, Newport News, and Mission Technologies. The Ingalls segment designs and constructs non-nuclear ships, including amphibious assault ships, expeditionary warfare ships, surface combatants, and national security cutters (NSC). The Newport News segment designs and builds nuclear-powered aircraft carriers and submarines, and the refueling and overhaul and the inactivation of nuclear-powered aircraft carriers. The Mission Technologies segment includes business groups focused on high-end information technology (IT) and mission-based solutions for DoD, intelligence, and federal civilian customers, life-cycle sustainment services to the U.S. Navy fleet and other maritime customers, unmanned, autonomous systems, and nuclear management and operations and environmental management services for the Department of Energy (DoE), DoD, state and local governments, and private sector companies. The company was founded on August 4, 2010 and is headquartered in Newport News, VA.

To download HII seasonal chart data, please log in or Subscribe.

To download HII seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: HII

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|