Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

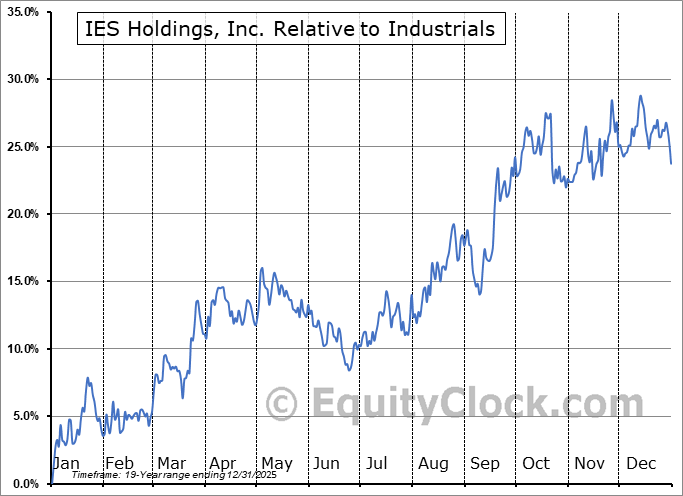

IES Holdings, Inc. (NASD:IESC) Seasonal Chart

Seasonal Chart Analysis

Analysis of the IES Holdings, Inc. (NASD:IESC) seasonal charts above shows that a Buy Date of January 31 and a Sell Date of May 21 has resulted in a geometric average return of 5.6% above the benchmark rate of the S&P 500 Total Return Index over the past 19 years. This seasonal timeframe has shown positive results compared to the benchmark in 15 of those periods. This is a good rate of success, but the return underperforms the relative buy-and-hold performance of the stock over the past 19 years by an average of 0.47% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

IES Holdings, Inc. engages in the business of designing and installing integrated electrical and technology systems. It operates through the following segments: Communications, Residential, Infrastructure Solutions, and Commercial and Industrial. The Communications segment provides technology infrastructure services such as designing, building, and maintaining communications infrastructure within data centers for co-location and managed hosting customers. The Residential segment offers electrical installation services for single-family housing and multi-family apartment complexes, as well as heating, ventilation, and air conditioning and plumbing installation services in certain markets. The Infrastructure Solutions segment includes electro-mechanical solutions for industrial operations including apparatus repair and custom-engineered products such as generator enclosures used in data centers and other industrial applications. The Commercial and Industrial segment is involved in electrical and mechanical design, construction, and maintenance services to the commercial and industrial markets in various regional markets and nationwide in certain areas of expertise such as the power infrastructure market and data centers. The company was founded in 1997 and is headquartered in Houston, TX.

To download IESC seasonal chart data, please log in or Subscribe.

To download IESC seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: IESC

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|