Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

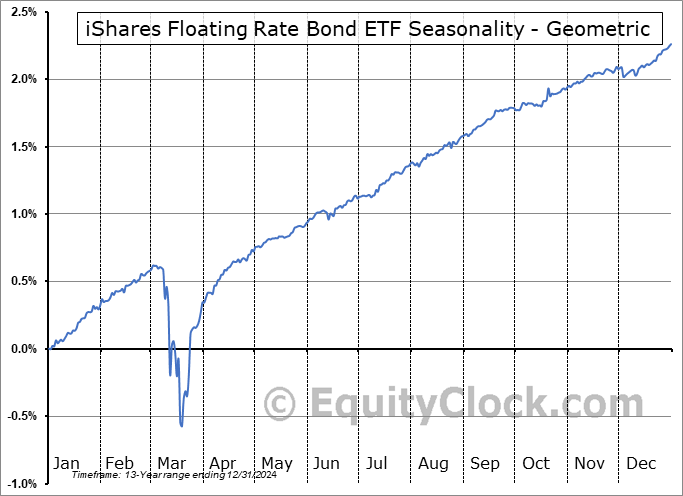

iShares Floating Rate Bond ETF (NYSE:FLOT) Seasonal Chart

Seasonal Chart Analysis

Analysis of the iShares Floating Rate Bond ETF (NYSE:FLOT) seasonal charts above shows that a Buy Date of July 22 and a Sell Date of October 12 has resulted in a geometric average return of 0.33% above the benchmark rate of the S&P 500 Total Return Index over the past 14 years. This seasonal timeframe has shown positive results compared to the benchmark in 8 of those periods. This is a fair rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 14 years by an average of 11.03% per year.

To download FLOT seasonal chart data, please log in or Subscribe.

To download FLOT seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: FLOT

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|