Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

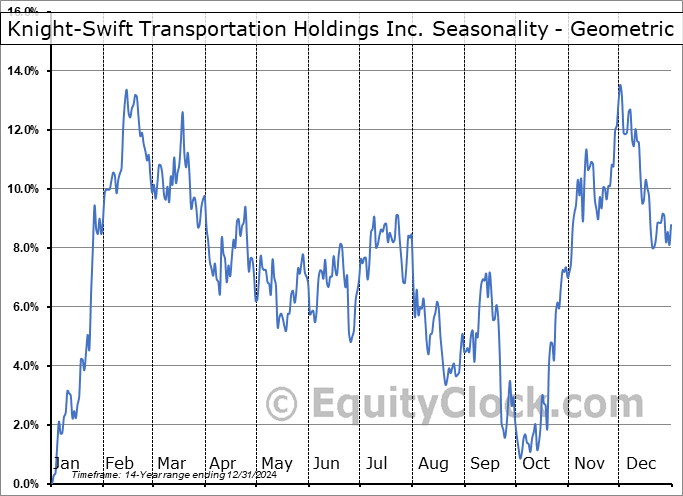

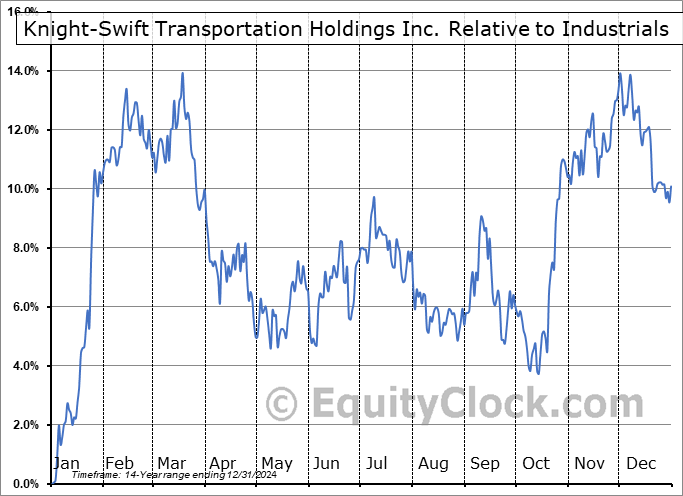

Knight-Swift Transportation Holdings Inc. (NYSE:KNX) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Knight-Swift Transportation Holdings Inc. (NYSE:KNX) seasonal charts above shows that a Buy Date of October 13 and a Sell Date of February 14 has resulted in a geometric average return of 11.79% above the benchmark rate of the S&P 500 Total Return Index over the past 14 years. This seasonal timeframe has shown positive results compared to the benchmark in 12 of those periods. This is a very good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 14 years by an average of 15.06% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

Knight-Swift Transportation Holdings, Inc. engages in the provision of multiple truckload transportation and logistics services. It operates through the following segments: Truckload, LTL, Logistics, Intermodal, and All Other. The Truckload segment includes irregular routes and dedicated, refrigerated, expedited, flatbed, and cross-border transportation of various products, goods, and materials. The LTL segment offers regional direct service and serves customers’ national transportation needs by utilizing key partner carriers for coverage areas outside of network. The Logistics segment focuses on a multitude of shipping solutions, including additional sources of truckload capacity and alternative transportation modes, by utilizing a vast network of third-party capacity providers and rail providers, as well as certain logistics and freight management services. The Intermodal segment is involved in the regional operating model, while also allowing to better serve customers in longer haul lanes and reduces investment in fixed assets. The All Other segment refers to support services provided to customers and third-party carriers including equipment maintenance, equipment leasing, warehousing, trailer parts manufacturing, warranty services, and insurance for independent contractors. The company was founded in 1966 and is headquartered in Phoenix, AZ.

To download KNX seasonal chart data, please log in or Subscribe.

To download KNX seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: KNX

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|