Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

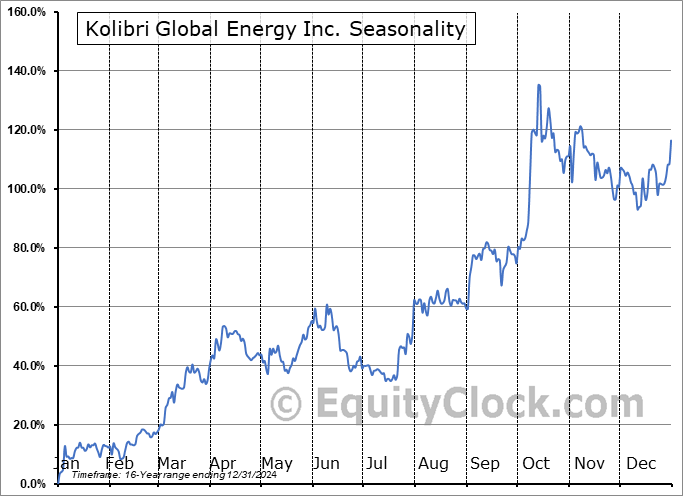

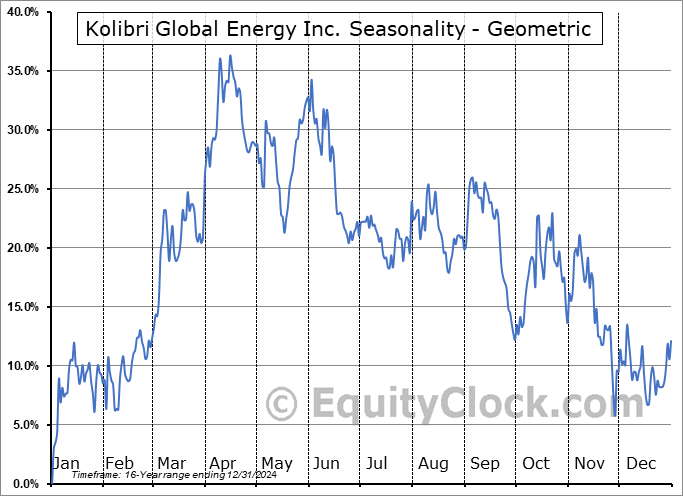

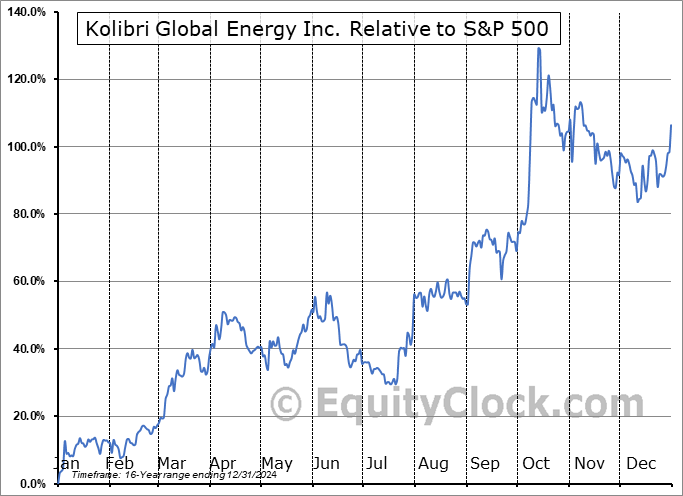

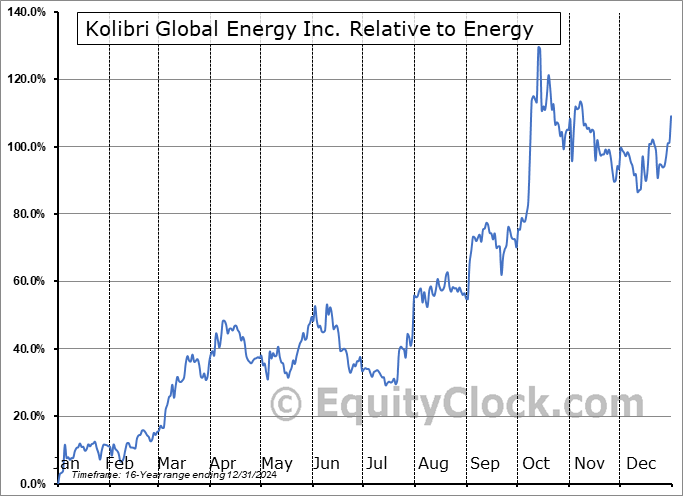

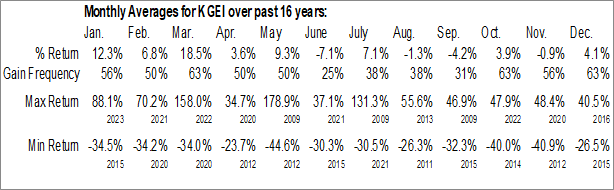

Kolibri Global Energy Inc. (NASD:KGEI) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Kolibri Global Energy Inc. (NASD:KGEI) seasonal charts above shows that a Buy Date of November 28 and a Sell Date of April 15 has resulted in a geometric average return of 36.11% above the benchmark rate of the S&P 500 Total Return Index over the past 17 years. This seasonal timeframe has shown positive results compared to the benchmark in 14 of those periods. This is a very good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 17 years by an average of 45.52% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Energy sector, which runs from January 21 to May 9. The seasonal chart for the broad sector is available via the following link: Energy Sector Seasonal Chart.

Kolibri Global Energy, Inc. is an international energy company, which focuses on finding and exploiting energy projects in oil, gas, and clean energy. It operates through the United States, and Canada and Other geographical segments. The company was founded on May 26, 2008 and is headquartered in Newbury Park, CA.

To download KGEI seasonal chart data, please log in or Subscribe.

To download KGEI seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: KGEI

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|