Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

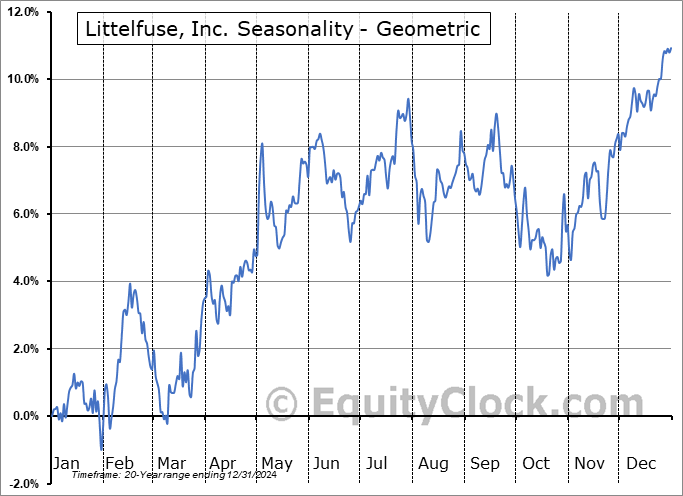

Littelfuse, Inc. (NASD:LFUS) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Littelfuse, Inc. (NASD:LFUS) seasonal charts above shows that a Buy Date of December 1 and a Sell Date of February 23 has resulted in a geometric average return of 4.06% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 16 of those periods. This is a very good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 2.47% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Technology sector, which runs from October 9 to February 15. The seasonal chart for the broad sector is available via the following link: Technology Sector Seasonal Chart.

Littelfuse, Inc. is an industrial technology manufacturing company, which engages in the business of designing, manufacturing, and selling electronic components, modules, and subassemblies to empower the long-term secular growth themes of sustainability, connectivity, and safety. It operates through the following segments: Electronics, Transportation, and Industrial. The Electronics segment includes a broad range of end markets including industrial motor drives, power conversion, automotive electronics, electric vehicle and related charging infrastructure, aerospace, power supplies, data centers and telecommunications, medical devices, alternative energy and energy storage, building and home automation, appliances, and mobile electronics. The Transportation segment focuses on circuit protection, power control, and sensing technologies for global original equipment manufacturers, tier-one suppliers and parts, and aftermarket distributors in passenger vehicle, heavy-duty truck and bus, off-road and recreational vehicles, material handling equipment, agricultural machinery, construction equipment, and other commercial vehicle end markets. The Industrial segment offers industrial circuit protection, industrial controls, and temperature sensors for use in various applications such as renewable energy and energy storage systems, industrial safety, factory automation, electric vehicle infrastructure, HVAC systems, non-residential construction, MRO, and mining. The company was founded by Edward V. Sundt in 1927 and is headquartered in Rosemont, IL.

To download LFUS seasonal chart data, please log in or Subscribe.

To download LFUS seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: LFUS

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|